Whilst measuring the impact of performance marketing comes with its own challenges, mostly due to privacy and technological pressures, understanding the true impact of brand investment has been notoriously difficult to measure.

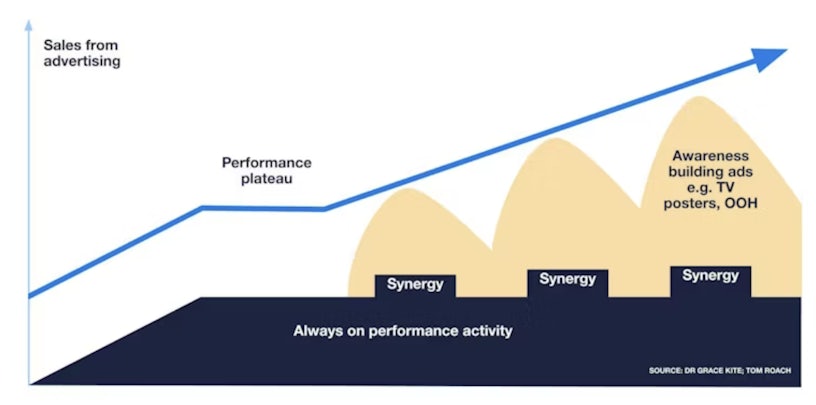

The importance of an integrated approach across the customer journey is well researched, with brand activation vital to overcoming the performance plateau. Research from sources like the IPA, Nielsen, and Google repeatedly shows that brands that balance long-term brand-building with short-term activation outperform those that focus on performance alone. However, closing the gap between what the research tells us and having the confidence to act on it remains a major hurdle.

The key to building that confidence lies in robust, meaningful measurement, giving marketers the tools to demonstrate the value of brand, not just as a creative or reputational asset, but as a commercial growth driver. Yet measuring the long-term effects of brand-building is inherently complex.

- Introducing holistic measurement

- Brand as long-term growth

- Controlling and growing demand

- Making measurement work across budgets

- For smaller budgets: Start with signals of intent

- For medium-sized budgets: Deepen insight with share of search and brand lift studies

- For enterprise budgets: Advanced brand measurement

- Branded visibility during growth or change

- Brand measurement helps you manage & protect visibility

- Your own data in Google Search Console

- Keyword volume data in third-party tools

- Demand data from Google Trends

- Granularity of brand data

- The top-level brand

- Associated brands

- Unique product & service terminology

- Measurement with a purpose

- Beyond Awareness: Measuring the true impact of PR

- Why Vanity Metrics Fall Short

- Brand Signals That Show Depth

- Brand Growth Indicators That Scale

- Connecting PR to Revenue

Introducing holistic measurement

Brand activity often affects customer decisions in indirect ways, takes time to show results, and doesn’t follow a simple or predictable path. This demands a more holistic approach, incorporating both real-time KPIs to guide optimisation, alongside methods that assess bottom-line business impact.

By holistically looking at KPIs across performance and brand activation, we can begin to understand how the two fuel each other. Strong brand equity isn’t just there to increase brand awareness; it is ultimately priming the user for action further down the line.

It builds familiarity and trust that reduces friction when a potential customer encounters a performance ad or searches for a category. As brand equity grows, we often see stronger engagement in search engine result pages (SERPs), increased ‘branded’ search, and reduced impact of price on buying choices. All support more efficient acquisition and improved retention.

This was demonstrated clearly in a recent case study from a luxury skincare brand.

The business launched a TikTok campaign aimed at raising awareness and building an emotional connection with a new audience segment. While direct conversions from the campaign were not the primary goal, the brand saw a 4-percentage-point increase in share of search, rising from 3% to 7% over the course of the campaign.

A sustained uplift in branded search volume and engagement with high-intent pages on the site mirrored this. While not directly attributable to last-click attribution models, these trends provided a clear signal of brand impact further down the funnel and offered the business valuable evidence to support future brand investment.

Brand as long-term growth

Marketers are frequently faced with the same scenario:

Business decision-makers are moving budgets away from brand campaigns because of the perceived inadequacy in driving sales.

However, we know this cannot be true. Consider the investment that some of the biggest and most profitable brands spend on brand marketing. They simply would not be able to justify doing so if there were no discernible link to sales performance. Here are a few that come to mind:

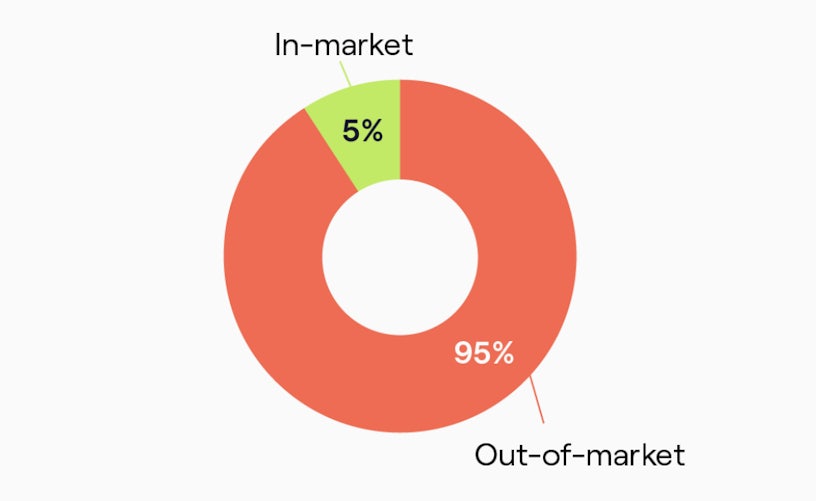

Sales-driving (‘performance’) activity is triggered by demand, for example, a user searching for a product and being served a PPC ad within their search results. But the volume of users who comprise this group is finite, potentially only 5% of the total volume of users who could be in-market for your product or service. Without tactics to increase the volume of your target audience, you will quickly reach your performance ceiling: when there are simply no more in-market users to convert. This is characterised by inflating CPAs and declining ROAS.

Controlling and growing demand

Brand media activity is essential to prime a larger, broader audience for future action. Done correctly, this introduces your brand to a far larger pool of prospects, the remaining 95% of your target audience, who are not currently showing in-market signals. Over time, and with consistent exposure, brand activity builds awareness, recognition and recall. When these audiences do begin to show in-market signals, they can be targeted by your performance campaigns, raising your Performance ceiling and unlocking incremental revenue opportunities and efficiency.

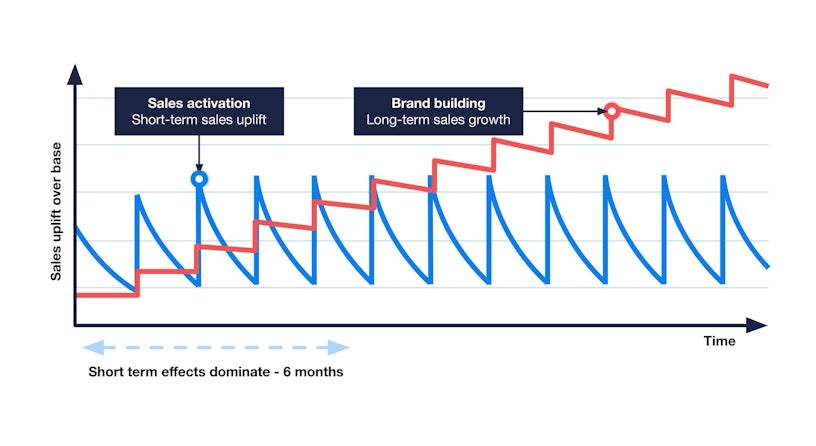

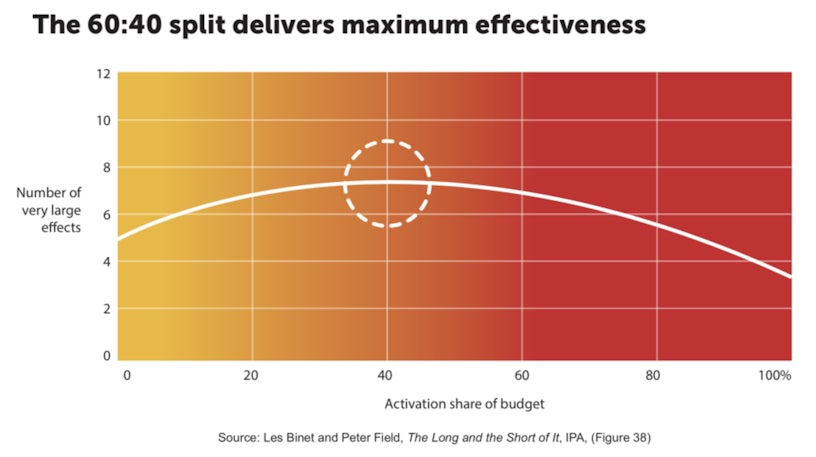

Our view that Brand is crucial for growth is not a new concept. Binet & Field’s ‘The Long and the Short of it’ concluded that both sales activation (short term, harvesting bottom of funnel demand) and brand building (long term, seeding top of funnel prospects) are necessary for long-term growth. In fact, they posit that the larger share of marketing budget (up to 60%) should be spent building the brand, and the more diminutive 40% on harvesting said demand.

So why are we still seeing deprioritisation, underinvestment and inconsistency in Brand strategy?

Brand and Performance continue to be siloed due to limitations in the reporting used to evaluate the impact of Brand. Imbuing traditional Performance metrics (ROAS, sales) on a Brand campaign wildly undervalues its impact, as most in-platform attribution models default to last-click measurement. Last-click favours tactics deployed at the end of the customer journey – like PPC ads triggered in response to a search – omitting credit from the Brand activity, even though a new customer may have started their journey there.

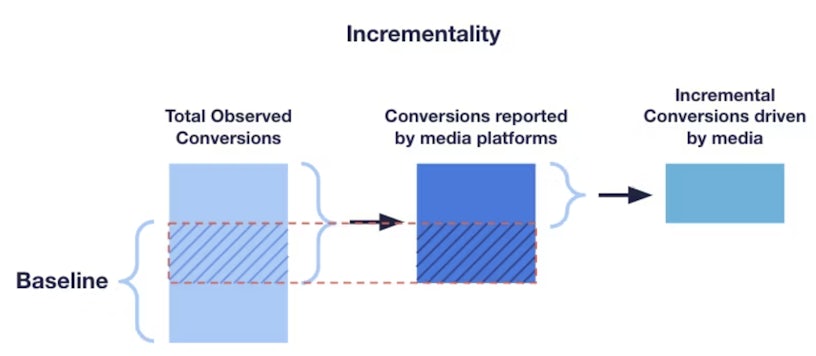

To understand the true value of Brand, we need to implement more sophisticated measurement. Impression deploys incrementality testing to isolate the impact of Brand campaigns on sales performance. For an automotive marketplace brand, a YouTube campaign needed to not only move the needle on a number of top-of-funnel metrics (including brand awareness), but also needed to demonstrate contribution to the business objective – leads. The campaign was able to deliver uplift in brand awareness and brand searches, as well as a 10% increase in incremental leads in the regions that were running the YouTube campaign. By contrast, in-platform (last-click) reporting captured only 3% of these leads.

Without appropriate measurement, this campaign could easily have fallen foul of the reporting limitations that undervalue the contribution of Brand spend to business objectives. Instead, it provides crucial evidence in favour of the essential role that Brand plays in supporting and driving sales performance.

Making measurement work across budgets

Whether your brand is scaling or already established, measuring brand effectiveness is possible with the right strategies tailored to your size and goals.

For smaller budgets: Start with signals of intent

Brand search demand reflects how often people search for your brand by name. A direct brand search signals that your marketing activity has made an impact, with the consumer now actively seeking you out. Tracking shifts in brand search demand following a campaign launch can help quantify its effectiveness by measuring how your activity is driving real-world visibility and engagement.

Tools like Google Trends and Answer the Public can be used to track this level of interest.

Measuring direct traffic in Google Analytics 4. When people are aware of your brand, they’re more likely to visit your site directly, rather than clicking through a paid ad or referral link. Growth in direct traffic suggests that your marketing efforts are successfully building recognition and recall.

If you’re running brand awareness paid media campaigns, you should be measuring ad recall. Many platforms provide estimated ad recall lift rates, which reflect how likely someone is to remember your brand after seeing your ads (typically within a two-day period). The more memorable and effective your ads are, the higher your ad recall lift rate will be.

Simple “how did you hear about us?” surveys conducted via email or website polls can be a fast and inexpensive way to understand why your brand awareness has improved, determining which of your marketing channels are most effective at driving visibility and engagement.

For medium-sized budgets: Deepen insight with share of search and brand lift studies

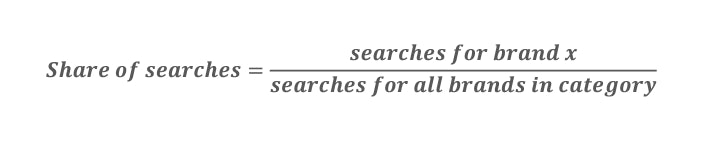

Share of search is a valuable metric for brands looking to understand how they compare to all brands in their category. It reflects the proportion of searches for your brand relative to total category searches, indicating how often you come to mind vs competing brands.Increases in share of search signal that your brand is effectively capturing attention and staying top of mind. It can also predict market share, providing an early signal of brand momentum before purchase decisions are made or conversion data becomes available.

Google Trends can provide a top-level overview, while platforms such as SEMrush, Ahrefs and Moz offer more granular insights on branded terms across multiple competitors. That said, the level of brand searches needs to be high enough for these tools to report on, making them more accessible for larger brands.

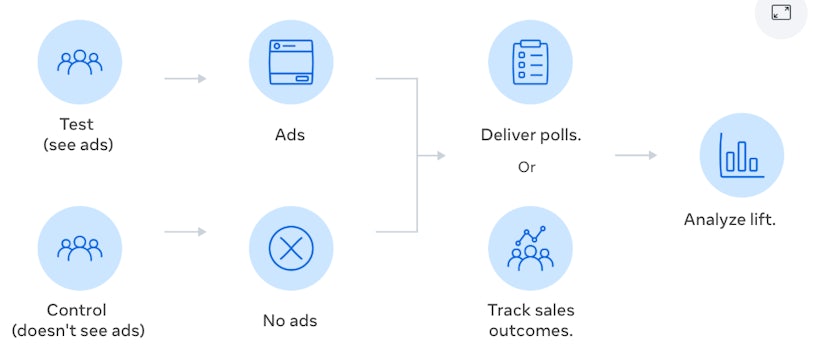

For brands wanting to understand the incremental impact of their brand awareness efforts, brand lift studies can be used.

By comparing responses from audiences exposed to ads with those from a control group, brand lift studies provide insights into how effectively your campaigns drive recall, brand awareness or purchase intent.

Brand lift studies typically require a minimum ad spend to achieve statistically significant results, making them more accessible for larger brands. For instance, a UK-based brand running a brand lift study on Meta needs to spend a minimum to gather meaningful data; however, this minimum may vary.

Despite these investment thresholds, brand lift studies offer a more nuanced understanding of how campaigns truly influence brand awareness. By meeting the necessary set-up requirements, marketers can leverage these results to inform future strategies and demonstrate the value of brand initiatives.

For enterprise budgets: Advanced brand measurement

For enterprise brands with diverse media strategies, third-party brand lift studies provide a comprehensive view of overall brand lift. These providers – like Nielsen or Kantar – are platform-agnostic, allowing brands to measure brand lift across multiple channels, campaigns or markets with consistent metrics.

While they come at a higher cost and may require significant media spend to reach statistical significance, third-party studies can deliver unbiased, cross-platform insights on how your initiatives are truly driving brand awareness.

Taking this a step further, multi-cell brand lift studies offer a more strategic approach to measuring brand awareness. By testing multiple campaign variables, such as creative styles, ad formats or target audiences, these studies identify which elements are truly landing with your audience and driving the strongest brand lift. Marketers can then use these insights to refine their brand-building strategies.

Multi-cell studies require larger audience sizes and higher impression volumes than single-cell tests. With this in mind, they’re best suited to enterprise brands with the scale and investment to support more granular experimentation. These studies can be conducted by both third-party research firms and within ad platforms.

Incrementality testing can be used to determine the causal impact of marketing activity on desired outcomes, such as brand awareness.

By comparing outcomes from a group exposed to marketing activity against a control group, marketers can understand the true effectiveness of their initiatives in driving consumer behaviour.

Incrementality tests can be useful in demonstrating the value of brand awareness activity. Because these initiatives rarely drive immediate, trackable conversions, their influence is typically under-reported in digital attribution. By highlighting the causal impact on awareness and recall, incrementality testing can demonstrate how these initiatives can contribute to long-term growth.

Due to the investment and data capabilities required to run the experiments, incrementality testing is best suited to enterprise-level brands.

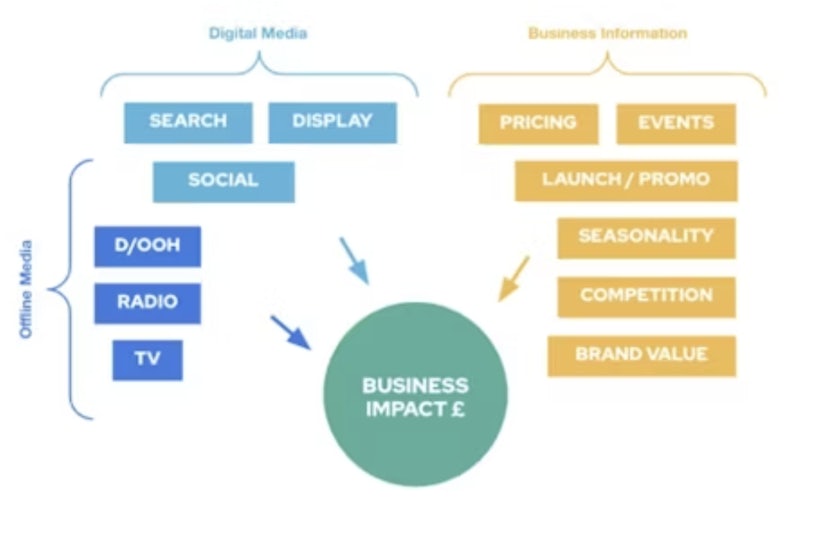

As brands diversify their media strategies, evaluating the true impact of brand awareness activity becomes more complex. Econometrics, often applied through Media Mix Modelling (MMM), can be used to understand how different media channels contribute towards achieving desired marketing goals, such as sales.

MMM analyses historical data to isolate the impact of each marketing channel, while accounting for context variables such as events, trends or seasonality. The results gained from an incrementality test can also be used to guide the model by providing causal data.

While it is possible to connect brand activity to purchase behaviour, the complexity of user journeys and the development resources required mean that MMM is typically only feasible for mature brands with sufficient historical campaign data.

Branded visibility during growth or change

Mergers, rebrands and migrations present unique brand challenges. Your business’s brand is an asset. A memorable brand makes it easier for people to find your site in search, and brands with unique names usually face very little competition for those searches.

However, brands don’t stay the same forever. Most businesses will go through periods of growth, rebranding, mergers or acquisitions that might require their names, logos and branding to change. In these situations, it is critical that a strategy is in place to measure and protect the reach of your brand in search.

There are two reasons why these periods can be so risky.

- Public perception of your brand changes. Searchers still use the old brand to search for you and need to understand and internalise the differences. It will take time to form new habits.

- Search engines need to understand the change. They need to be able to connect the old brand to the new so that searches for any variation end up in the right place.

With proper measurement of your brand’s presence in organic search, you can mitigate these risks and help propel your business through a potentially turbulent time.

Brand measurement helps you manage & protect visibility

Three brand measurement methods work particularly well for organic search.

Your own data in Google Search Console

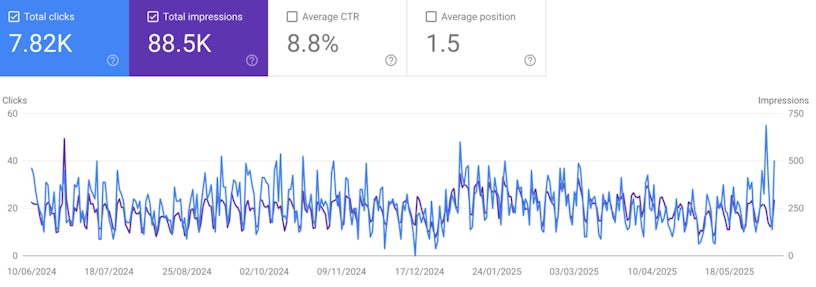

Google Search Console tells you the exact search terms people are using to find your website. When measuring the reach of your brand, filter for variations of the business’s name and look at clicks (to see what is actually leading to traffic) and impressions (to see overall search demand).

If the goal is ultimately to protect your brand traffic in a risky period, use a long date range (at least 12 months) to get the best view of search behaviour.

When you know how people actually find your brand, you know the scale of what you need to protect. You might want to consider ways to protect rankings for those terms with pages referring to the change from your old brand to the new one. You can also use the data as a benchmark to measure the success of a new brand launch over time.

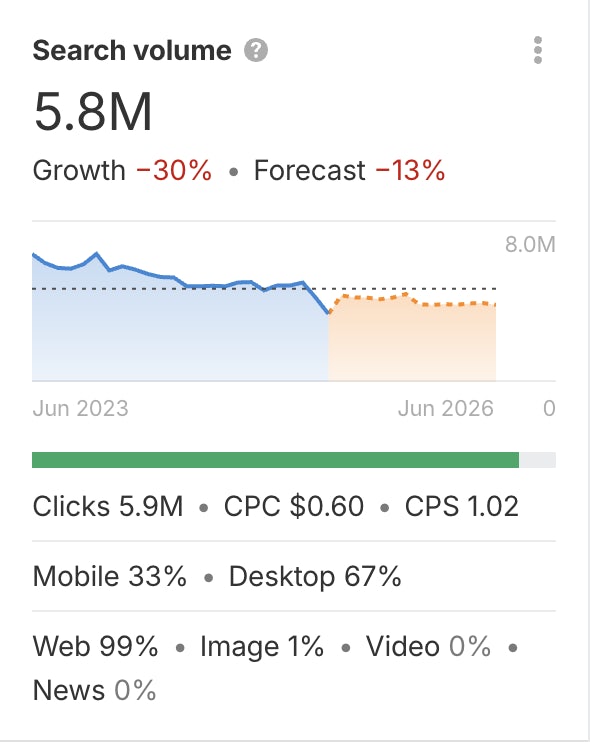

Keyword volume data in third-party tools

Third-party data shouldn’t be a substitute for data from Search Console, but it can be complementary. Take monthly search volume data from a tool like Google Ads, Ahrefs or Semrush to monitor changes in overall search demand over time.

This provides an excellent means of monitoring shifts in user behaviour before and after a change in brand. Even outside of change periods, it can be a useful way of monitoring your brand’s popularity in the wider market.

However, if the trend in third-party data is ever different to what you see in Google Search Console, believe the latter. Search Console will show you how people are actually interacting with you, and that is far more reliable than an external estimate.

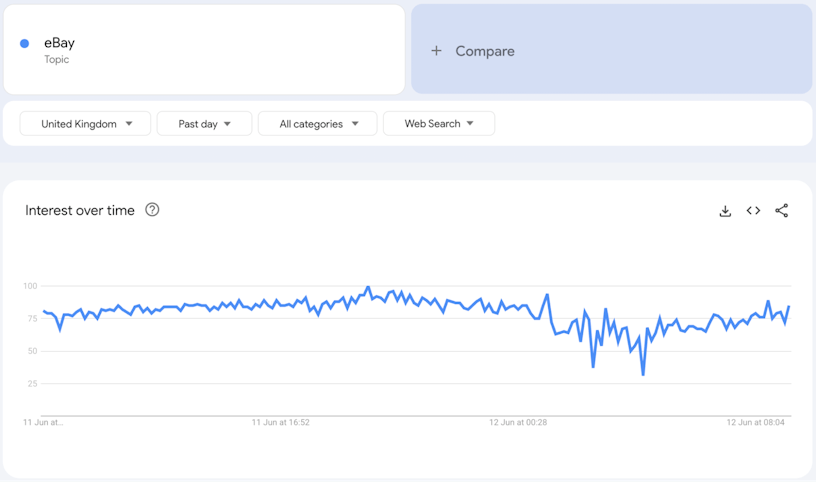

Demand data from Google Trends

Finally, as we have mentioned previously, you may also want to look at Google Trends, which provides a relative index for monitoring search terms and topics. It can be used to view demand for a brand as a whole, rather than breaking it down into individual search terms.

The data itself is less granular, as it shows demand on a relative scale of 0-100, but it is useful for comparing your brand with competitors or for monitoring change over time. Again, however, it should not be taken as truth over your own website data if there is a conflict.

Granularity of brand data

During periods of change, when accurate monitoring is particularly critical, it is important to be sure that the scope of your brand measurement is correct. That means defining everything that could be considered a brand search, i.e. capturing all terminology that is uniquely associated with your business.

The top-level brand

Your business name and its closest variants should always be the core focus of your measurement and protection efforts. Use Search Console and other tools to identify exactly how people search, most importantly, don’t make assumptions. It is especially important to monitor all variants when your business name is an acronym, a merging of other names, or has a common abbreviation. If your business name is shared with others or is a common word, you should also look for distinctive ways of searching for your brand. For example, we might monitor “impression digital” or “impression agency” alongside “impression.”

Associated brands

If your business has acquired others or been part of a merger in the recent past, it is also worth monitoring any other brand terms that are still commonly associated with you. Use Search Console to verify terminology with existing search demands, and consider how you will protect that traffic, especially in instances of further branding changes. It may be worth considering how you could create educational content to help searchers move from older terminology to new.

Unique product & service terminology

The final category of brand terms to monitor through periods of change is the other terms that are part of your brand marketing, but not the name of the business. These terms are common in all kinds of businesses, and could include:

- Own-label products and ranges, such as Clarins’ Double Serum range.

- Uniquely named services and solutions, such as Specsavers’ easycare contact lens subscription.

- Other names, events & copyrights associated with the brand, such as The Access Group’s Access Evo.

They may not be affected in the same way as the core brand in a big merger or migration, but they can be vulnerable to other changes to your business’s offering or competition from other sites, especially in the case of product ranges that are sold by resellers as well as your own website.

Measurement with a purpose

Whatever level of measurement is required for your brand, set it up with a purpose in mind. We’ve focused on times of change in this section, but there should always be a reason for monitoring your brand in search. It could be anything from helping the wider business understand market demand to tackling a particular brand recognition change or challenge. Establish your goal, gather the data you need, then act.

Beyond Awareness: Measuring the true impact of PR

We’re focusing on PR in this section because of its growing strategic value in shaping brand sentiment and perception, particularly compared to traditional organic metrics. As discovery shifts to social platforms and AI-generated results, PR plays a critical role in influencing both consumer trust and algorithmic visibility.

For years, successful PR has been measured in metrics like backlinks, coverage numbers and impressions, but none of these answer the question: what did this do for our brand?

Now we live in a world where searchers turn to platforms like TikTok or Instagram for recommendations, and Large Language Models (LLMs) rely on trust signals to provide more credible answers, further highlighting the need to move away from vanity metrics when measuring what your PR has actually achieved.

Why Vanity Metrics Fall Short

If the goals and aims for your PR activity are still linked to volume of coverage or estimated coverage views, you’re missing part of the picture. These goals might give you an insight into output, but they don’t tell you how impactful those outcomes are.

PR isn’t just about gaining coverage; it’s about making sure the right people are there to see and engage with it. Today’s PR impact needs to be measured by what people do or feel, not what they might have seen.

So, what should we be tracking to measure the impact of PR on your brand?

Brand Signals That Show Depth

These metrics go beyond surface-level quantity metrics and give insight into how your activity is growing brand equity over time.

- Branded search volume: Show demand and salience over time

- When branded search volume grows following PR activity, or if you can plot search spikes around large campaigns, it shows that people aren’t just seeing your coverage, but they are remembering your brand. Increasing branded searches over time is a strong indicator of mental availability and sales growth and can be tracked through tools like Google Trends or MyTelescope.

- Referral traffic from PR coverage: Show engagement and intent

- If people are seeing your coverage in the wild and clicking through to your site, this shows real engagement. This metric is key to track, not just to measure the impact of activity, but to help inform strategy. If you know the publications and topics that turn readers into potential customers, this can help to tailor your strategy even further.

- Trust signals: Mentions & spokespeople featured in reputable content and external validation

- Trust and expertise are the foundation of brand equity. Being featured or mentioned in high authority publications, especially those that have real authority in the topics relevant to your brand, helps to build trust with both customers and search engines.

Brand Growth Indicators That Scale

Alongside metrics that show depth, these indicators give a broader view of your brand in the market and how PR is impacting that.

- Sentiment analysis: Use NLP tools to track shifts in tone over time.

- Sentiment tools help you gain insight into how positively or negatively your brand is being talked about across media platforms. Successful PR should not only increase your visibility but also help boost how your brand is viewed. This is especially key in sectors like YMYL (your money your life), where trust and perception are key.

- Share of voice: Not just in volume, but in quality placements vs. competitors.

- By tracking how much of the conversation your brand owns compared to the competition, you shift your focus away from quantity and more onto quality. Appearing in publications that have high levels of authority or engaged readers indicates stronger brand authority.

- Content syndication/repurposing: How PR stories are amplified across other brands or partner channels.

- For a long while, syndicated content has been looked at negatively from a digital PR perspective, but when you dismiss syndicated content, you miss the point. If a story is shared by other sites, on social or via influencers, you’ve created something that has resonated with an audience.

Connecting PR to Revenue

PR isn’t just about visibility, it’s about influence and impact. By tracking metrics like branded search, referral traffic and sentiment, we can start to draw a clear line between PR activity and business performance.

These metrics don’t just show that someone saw your brand, they show that they engaged with it too. When integrated with broader marketing goals, PR becomes more than a storytelling tool; it becomes a measurable channel that helps to grow your brand and business.

PR is no longer just about the story told; it’s about how that story travels, resonates, and ultimately converts. When measured with intent, PR becomes a tangible driver of brand equity and revenue growth.