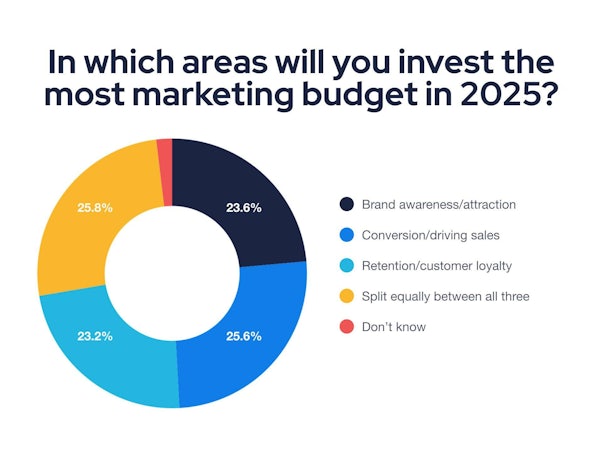

In a recent study by Impression, research showed that 61% of marketers expected to increase their marketing budget in the next 12 months, but out of 915 marketers surveyed there was a split on where they thought it would be best to invest their budget, including a surprising near 30% who were allocating “equally” or just didn’t know. This is a real-world example of the challenges marketers face.

Sometimes the information needed to make a solid media plan just isn’t available because the measurement and insight just isn’t there. Or in other cases, insight exists, but marketers and their agencies lack the translation into actionable strategies for media planning budget optimisation. This is what we will tackle in this blog.

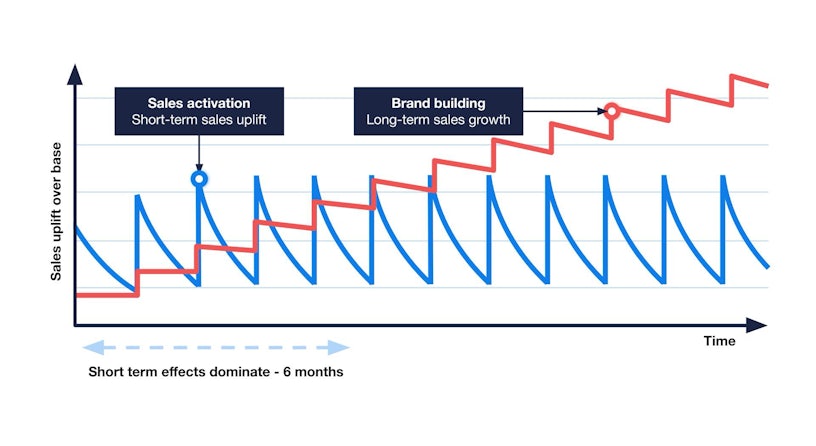

Media budget optimisation and marketing channel selection are critical challenges for marketers. Achieving the perfect balance between long-term brand building and short-term performance marketing is increasingly complex, especially with the proliferation of digital and offline media channels. That’s not to bring into question the definitions and purposes of each type of activity. For the purposes of this blog, long-term activity should seek to build equity in a brand which increases baseline sales and sometimes increases performance marketing effectiveness, over time too, as seen below in Les Binet & Peter Field’s The Long and Short of It.

There is no single ‘ideal’ ratio to aim for, as success lies in understanding what your audience needs and ensuring that your marketing efforts deliver both immediate impact and sustained future growth. While short-term activation drives sales in the moment, long-term brand building strengthens awareness, trust, and importantly, preference over time. The key is to find the right balance of investment for your brand while adapting to evolving market conditions and consumer behaviours.

There are, however, long-established industry findings that can serve as benchmarks, depending on factors such as business maturity and industry sector. Striking the right balance in investment priorities will always be a shifting challenge. In the long-term, many brands will ideally invest more in brand equity and audience development, rather than focusing primarily on short-term, sales-led activity.

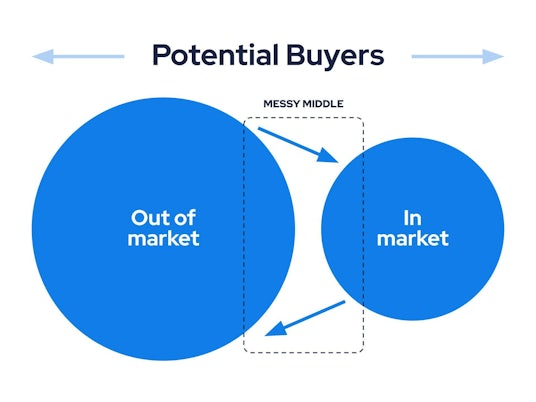

This ensures that an audience is continually being primed beyond the immediately serviceable “in-market” segment, which performance marketing channels can efficiently capture at a strong rate of attributable efficiency.

But how do we find the right balance? This is where insights from audience research, Marketing Mix Modelling (“MMM”) (also generally referred to as ‘econometrics’) and incrementality testing – techniques that together serve as the ‘gold standard’ of media measurement– come into play.

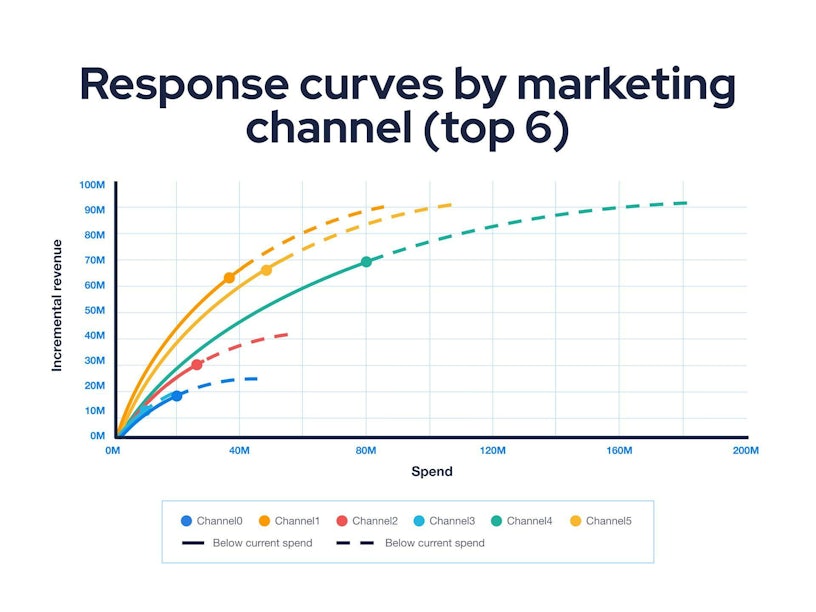

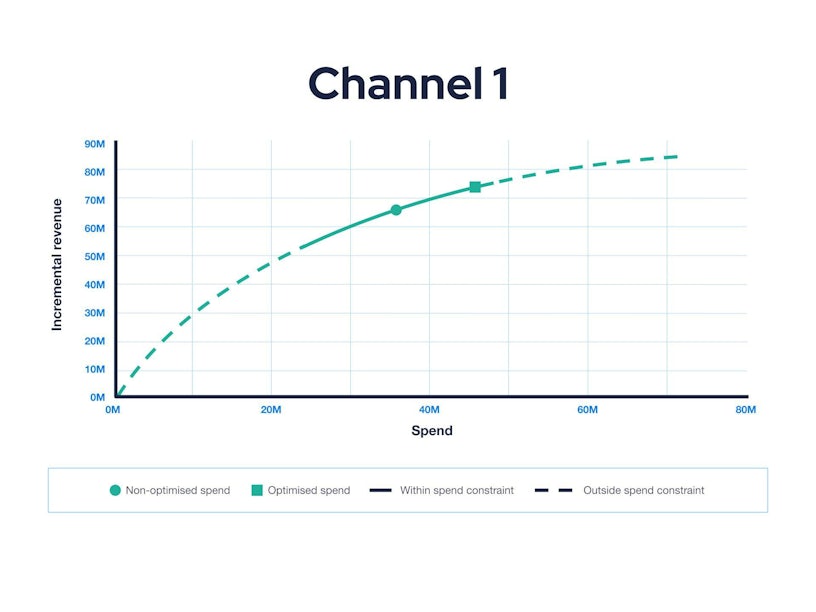

For example, techniques like Marketing Mix Modelling help you understand the longer-term correlations of business outcomes (revenue) and the variables which most likely drove them (marketing channels, price discounting or otherwise). A refined marketing mix model can ultimately help optimise budget allocation to meet your business objectives. MMM models and estimates the performance of each marketing channel, pinpointing the point of diminishing returns in each channel or objective in a mix of media investments, and then runs scenarios on differing investment levels and media mixes to establish the best overall outcome.

In this blog, we’ll take a deep dive into both foundational and advanced strategies for effective media budget allocation. We’ll also explore how measurement and planning approaches, like Marketing Mix Modelling, can provide data-driven insights to help optimise media spend by analysing true performance across different channels, ensuring you get the maximum return on investment (ROI).

- What is Media Budget Optimisation?

- Foundations of Media Budget Optimisation

- 1. Design the Digital Strategy

- Audience research

- Business objectives

- 2. Defining a clear KPI framework

- 3. Establishing a measurement plan

- Advanced Media Measurement Techniques

- Marketing Mix Modelling (MMM)

- Incrementality Testing

- 4. Channel selection, Planning and Forecasting with Data

- Forecasting and planning with attribution data

- Forecasting and planning with contribution data

- The media planning cycle

What is Media Budget Optimisation?

The idea behind media planning and budget optimisation is the process of ensuring that your investment achieves the best possible results. Budget optimisation isn’t a static process; it’s a dynamic one, where allocating and adjusting marketing budgets across various channels and campaigns can be altered throughout their life cycle as new data arises and time passes. These data-driven insights and measurement tools, as a result, should lead to increased reach, engagement, conversions, and ultimately ROI.

The overarching goal of this process is to minimise ineffective spending across several levels, including across and within each channel in the marketing mix, taking into account baseline sales and other non-media variables.

As online ad costs continue to rise and new competitors continually enter the market, ensuring your investment delivers maximum value is essential. Unoptimised channels lead to wasted resources and ineffective performance, ultimately impacting ROI and growth.

At the heart of media effectiveness is the need for high-quality, accurate and diverse data that includes key factors that influence performance, such as digital ad spend, broadcast and print media ads, promotions, events, pricing and other external influences.

Thanks to the dynamic nature of budget optimisation, these methods give you the agility to quickly respond to market changes and emerging opportunities.

Foundations of Media Budget Optimisation

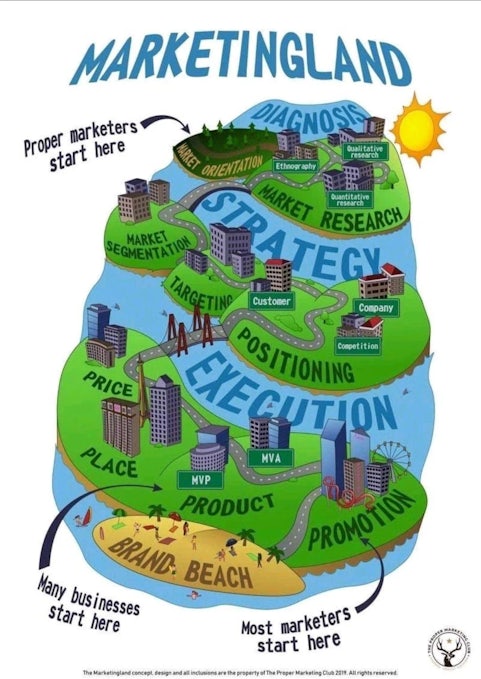

The foundations of great, effective advertising are rooted in research, marketing strategies, media planning, ongoing optimisation, and more. Something we don’t touch on in this piece, but is equally important in effective marketing, is the creative execution.

Below, we’ve laid out a few of the more important steps in setting out a digital strategy and media plan, just as an indication, so that it’s clear how and where media planning and budget optimisation fits.

1. Design the Digital Strategy

Audience research

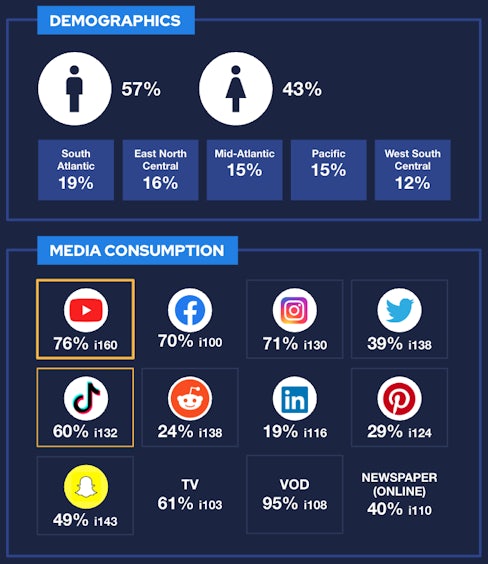

Audience definitions, segmentation and targeting have always been a fundamental part of marketing theory. To target audiences effectively, whether via digital media or traditional media, it’s important to understand their habits and media consumption, preferences and affinities.

You need to rely on accurate audience data to inform your campaigns, whether it’s from social media platforms, general search interests, or data-driven from those who click on your ads. We have a guide to digital marketing insight tools to help you find out which may be best for your business as its current level of maturity.

For example, younger demographics may spend more time on TikTok or Instagram, while older audiences may prefer Facebook or traditional TV. Taking time to understand what they are and what they are not is one of the basic first steps to budget optimisation.

Everyone is ultimately an individual, but based on grouped traits, it’s possible to create groupings. We typically do this with surveyed, observed and modelled data available to us in planning and buying platforms. Based on a taxonomy, individuals generally are over- or under-indexed in certain areas, and we can analyse these to understand how large an audience is.

Business objectives

A broader question than the marketing objectives would be the business objectives, and sometimes these can appear to be conflicting or unclear at first. Taking a deeper look under the hood, and at the product positioning in the market landscape, is sometimes tempting to overlook when there’s a media plan and forecast to produce; however, this insight and awareness can shape the ‘jobs to be done’ by the plan itself.

This diagram by one of Mark Ritson’s students on the Mini Marketing MBA highlights just how much strategy there is to consider, at least before the tangible marketing should begin.

To work out exactly what these ‘jobs to be done’ are, there are a variety of approaches and methodologies in the marketplace, including our own ‘Growth Dynamics’, which seeks to map or explain what good marketing investments look like and how to apply them.

Broadly speaking, all good marketing advice holds the same idea:

- Only a minority of your addressable market will be ‘in market’ at any one point in time

- Advertising generally does one of a few things, broadly grouped into: taking action, or building awareness

- Brands that want to be around in the medium and long term should consider advertising to both in-market and out-of-market audiences, and give them appropriate messages, i.e. not everyone will take action immediately.

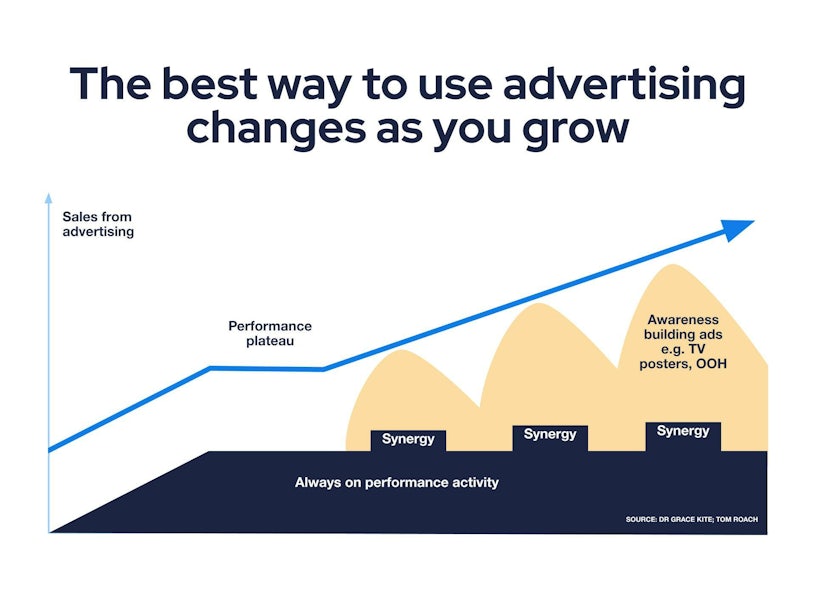

‘The Long and the Short of It’ by Les Binet and Peter Field recommends a roughly 60:40 split between long-term brand-building campaigns and short-term demand capture. This original study has since been revisited, offering more clarity by looking at more specific ‘ideal’ splits for businesses at different levels of maturity and industries, and a similar truth still holds true across the average.

Of course, this was only a recommendation, and your actual budget allocation must be backed by historical evidence to inform greater investment decisions or channel diversification, but there is strong evidence (from WARC) to suggest a ‘Multiplier Effect’ of running both types of activity in the same audience simultaneously. This evidence-based approach ensures a balanced strategy that supports both immediate sales and sustainable growth.

- Longer-Term (60%)

Invest in channels that deliver broad reach and emotional connection over time, such as OOH, broadcast media, and digital video (e.g., YouTube). - Shorter-Term (40%)

Focus on performance-driven channels like paid search, social media ads, and retargeting to drive immediate results at the bottom and middle of your marketing funnel.

We’ve also seen models published by industry effectiveness commentary Dr Grace Kite and Tom Roach, including ‘The Performance Plateau’, which seeks to explain the challenges of brands which are over-indexed in performance media, which naturally has a ceiling to its effectiveness and efficiency.

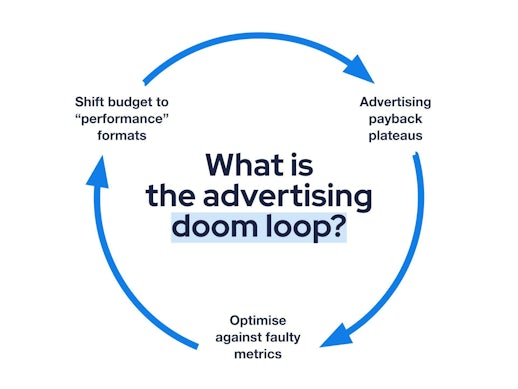

The WARC Multiplier Effect whitepaper also explains its own model; the ‘Advertising Doom Loop’, which describes the same challenge of where businesses don’t invest outside of performance media.

It’s easy to see how these situations come about, as digital performance advertising platforms are so good at providing their own attribution and the claim that the sales were because of, in part, them.

It’s for this reason that at Impression, we use our Growth Dynamics framework to clearly outline our plans. And from what follows are the relevant measurements and evaluations of each one.

2. Defining a clear KPI framework

KPIs that matter to a CFO will differ entirely from the CMO, trading team or those with hands-on access to advertising platforms. A hierarchical KPI framework tackles this and lays out the “what” of the question of KPIs to report on.

Check out our marketing plan blog to see more of what this looks like in action. Plans with KPIs which lack vertical alignment won’t lead to the best results.

3. Establishing a measurement plan

We see KPI frameworks and measurement plans as different tasks, with different stakeholders. A measurement plan is the ‘how’ in the question of KPI measurement, as we explain in this linked video.

Measurement plans also consider how and when data is collected, cleansed and reported. To accommodate the KPI framework, which will absolutely include attribution and platform metrics. Digital attribution is still incredibly important because it’s tangible and available day to day. But, our measurement plans will also consider incrementality testing and econometrics marketing mix models, too, which support budgeting decisions at more macro levels.

Geographic regions are important when it comes to data-driven media planning, which requires incremental testing. We typically use regions, counties or states, depending on the market, the overall geographic distribution, and the best fit for the business. This consideration is to align measurement with the media buying, either being planned or already in flight so that we can measure its effects more simply.

Concerns and challenges with digital attribution and the underlying data tracking include: Are we mitigating technology challenges as best we can, and are we ensuring compliant data capture? Are there multiple digital properties that also need considered separately, i.e. websites and apps for the same business units?

Advanced Media Measurement Techniques

Marketing mix modelling and incrementality testing is a fundamentally different approaches to media measurement than attribution. These approaches use broader sets of data for additional context and are calculated in part with statistical models. It’s through this approach that rigour is introduced. These models also give statistical confidence intervals to demonstrate how likely the results shown are true. This ability to get a measured read on the level of uncertainty in media performance, which allows for effective media planning and ongoing testing recommendations.

Marketing Mix Modelling (MMM)

Marketing Mix Modelling is a statistical approach that analyses historical revenue and channel cost, impressions, gross rating points and external control data to determine the effectiveness of different media channels. It looks at how various marketing efforts contribute to business outcomes. MMMs help marketers understand channel effectiveness by using advanced statistical analysis and modelling techniques, quantifying the impact of various marketing activities on KPIs. Once you have a solid understanding of how channels perform at different media investments, and in relation to one another, data scientists and marketers can then produce scenario plans based on different budget allocations and these can be taken forward into new media experiments and forecasting work. MMMs are long term correlative studies, and work best where different channels have differing levels of investments over time, to assist with drawing better correlation analysis outcomes.

Incrementality Testing

Measuring the true impact of a marketing channel or campaign on your business is a common challenge in digital marketing. Every form of advertising, including long-term brand-building efforts, should drive incremental sales, but quantifying its exact contribution remains difficult. If you’re looking for ways to accurately assess and attribute media performance, incorporating incrementality testing into your strategy is essential.

Incrementality testing differs in its approach to media effectiveness measurement from that of Marketing Mix Modelling because incrementality testing is a causal approach; it measures the cause and effect of advertising exposures on KPIs. Incrementality testing can reduce the uncertainty associated with running an MMM programme, feeding in incrementality test results as ‘prior’ information for improving the accuracy of the model.

4. Channel selection, Planning and Forecasting with Data

Channel selection by this point of the research will be shaping up nicely. But ultimately, we need to be present where the audience is present.

We also may want to consider externalities, such as competitor activity, but this will very much depend on the situation.

Do we also have a good mixture of platforms and formats available to us in the plan, so that we can achieve all of the jobs to be done? That is – both driving awareness and action.

Producing a forecast isn’t always the simplest of requests, and much of this will come down to the data you have available to you and the number of unknown variables. There’s also a variety of options available to you, and not necessarily one best answer.

However, there are broadly two approaches depending on whether you are limited only to digital attribution (analytics and ad platform) data, or whether you have more insight from MMMs. Having just a couple of incrementality test results to hand can also improve attribution-based forecasts, allowing you to moderate platform projections in line with hard facts.

Forecasting and planning with attribution data

Simpler regression methods, such as Autoregressive Integrated Moving Average (ARIMA), a moving average calculation, or Meta’s open-source Prophet library, can help extrapolate historical data and project it into the future. This simplistic approach can help give a broad indication of where data is likely to trend in the future, and these methods account for seasonality and holiday effects quite well.

This approach could be useful as many ad platforms will also show modelled return on investment curves to show marginal ROI growing, and then tailing off at higher investment levels, depending on your target audience.

The challenge here is that attribution is always generous in its claims for supporting sales growth. The baseline of sales it captures isn’t easily replicated, and so projections into the future can be misleading. They will always need to be moderated downwards so that this baseline sales error isn’t carried forward.

Previous incrementality tests can begin to improve your attribution-based forecasts and laydowns, because with these test result,s you can moderate your projections appropriately. We sometimes see the use of coefficients from data-driven attributed ROAS to incremental ROAS (iROAS) used in these forecasts, which can help bridge the gap before MMMs are conducted.

Forecasting and planning with contribution data

Laying down a media plan and forecasting are significantly easier once the more challenging work of adopting an experimentation-backed approach is done. By measuring the contribution of each channel, exclusive of one another and baseline sales, you will gain clarity and confidence in which investment is driving tangible return on investment, and as such, using this in the future is simpler.

This approach to planning and measurement, incorporating incrementality testing and marketing mix modelling, is the ‘gold standard’ approach. It’s one we feel all mature businesses should be aiming for.

Marketing mix modelling uses regression analysis that determines the long-term correlations between several variables (channels + context), all on one outcome, usually sales. It handles all seasonality, holidays, and so much more, such as pricing variables and seeks to understand the relationships between them all over time. For this reason, it can be seen as a significantly more complex approach to modelling media, generating insights and providing a platform for forecasting.

From an MMM, you receive channel-level insights including;

- Response (or saturation) curves, which show the likely ROI at every investment level, and

- Adstock curves showing the delay between investment and return on investment per channel,

Response or saturation curves (see below) can take a reading from these for increased or reduced investment on an individual insight level.

However, you can take these insights further and then use the model to forecast and scenario plan holistically. These forecasts typically seek to do one of two things, and for each, the balance of media investment may be different. Such as;

- Maximising the revenue/key KPI, or

- Driving the best efficiency with fixed costs.

When forecasting, the numbers on face value will be optimised to the forecast objective, so additional context and constraints should be considered and added by experienced media strategists so that the jobs to be done – get done.

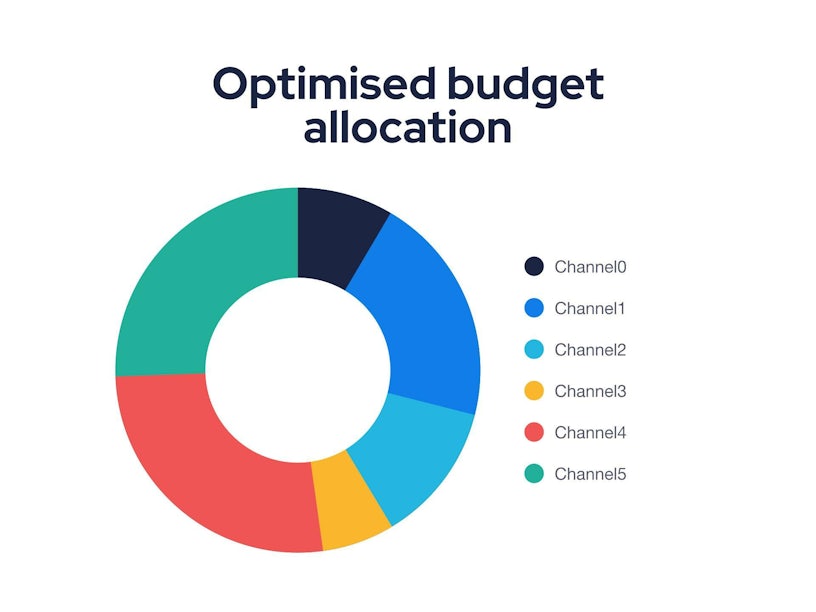

In practice, this means refining the numbers to inform how investment is allocated across media channels. These will be shown in tabular formats in your monthly laydowns, but lots of MMM platforms also illustrate them (see below), which allows for quick interpretation of the media investment movements over time.

But remember, marketing mix modelling only looks backwards. For activities not previously run, consider referring to benchmarks and platform reports, but always consider designing tests into your platform and channel launches so that you can establish their value sooner rather than later.

For brands that don’t have a wide amount of data on hand, incrementality testing is always a great idea, where it’s possible, as it’s something that can be designed to be run in the short-term. MMMs aren’t great for early-stage startups, but best for businesses with only stable media investments over long periods, or for those with low complexity in their media investments. All of these situations leave the data without patterns nor signals to build correlations from, or simply lack sufficient data to capture annual patterns.

A long-standing challenge with attribution is that the combined contribution of all channels often exceeds 100% of revenue. However, as media planning evolves to focus more on contribution rather than strict attribution, it becomes easier to justify results and communicate forecasts with greater confidence to stakeholders.

The media planning cycle

Media planning and budget optimisation should evolve, over time, from annual planning and guesswork to incremental revisions in an ongoing process. This is all because of a few reasons, including:

- Quality data capture on the attribution platforms for channel decisions

- The experimentation-led approach across media as a whole

- The movement towards MMMs – which can be refreshed

- Budget optimisation and scenario planning, which adjust for new learnings as they’re incorporated in the MMM.

This journey isn’t an instant one, and serves mostly as a north star, something for you to aim for.

Any progress towards this goal is a positive one, and it’s something we’d love to support you on if you’ve for this far and you’re interested in maturing your media planning and measurement. Get in touch.