Data is at the heart of everything in digital. First-party data helps marketers understand their users and make strategic decisions.

However, with first-party data alone, marketers aren’t quite able to understand the whole picture. It doesn’t give us access to what trends the industry is seeing, what our competitors are doing, or any insight into our prospective users.

The importance of combining first-party and third-party insights

Third-party data is what helps us as marketers contextualise the first-party. By combining the quality of first-party data with third-party data from a range of different sources, we are able to have the depth of data needed to make accurate and informed decisions.

Marketing strategies are made up of a range of different recommendations and in order to make these recommendations, we need insight. It’s important for us to be as confident as possible in our decisions. To do that, we need to have data. But once we have that data, what do we do with it? For data to be valuable, we need to understand exactly why something has happened. If we’ve seen market share decline, what are the reasons for this? Is it due to reduced activity? Have your competitors diversified their media mix? Understanding why something has happened is what helps us react and respond appropriately.

The more robust your data, the more confidence you have in it and the better your strategic recommendations will be. Access to this data will mean your decisions are data-driven, informed not by assumptions or opinions, or even just experience. The world of digital is constantly changing and without staying on top of the latest trends, it’s easy to fall behind. With insight we are able to make our marketing personalised – if we know who our prospect audience is and what they are looking for from their brands, we can ensure our marketing is tailored to this. Ultimately, basing recommendations on insight will set you up for making decisions that will drive effective media.

Finding the right data insight tools

So, where’s the best place to get your data from? There are a few tools that fall under different categories, these being…

Competitor research

This one is important, as you will want to be up to speed with the businesses you are actively trying to acquire market share from. Some of the questions you might be trying to answer are…

- Who are my competitors?

- What channels are they using?

- What is their comms strategy?

- How much media spend do they have?

Audience profiling

Another important category, your consumers should always be front of mind. For this category, you may be trying to answer…

- Who is my audience?

- What online behaviours do they have?

- What do they expect from their brands?

- What is their media consumption?

Market landscape

These tools are significant for contextualising your performance. For this category, you may be trying to answer…

- How big is the market?

- Is it growing or declining?

- Who are the big players?

- What are the future predictions?

Social listening

Lastly, you should also be considering these tools when trying to answer the following questions…

- What is the online sentiment?

- How are people reacting?

- How does your brand make people feel?

- How do your competitors make people feel?

Ultimately each tool will be able to help you answer a specific set of questions based on your requirements. Various businesses will have different requirements depending on their size, industry, and structure, so it is crucial that you choose the right tool to answer your questions.

These are some of the things you need to consider;

- Are you responsible for your tool stack or will you rely on your agency’s?

- How many verticals do you work with?

- Who is your target audience?

- How many markets do you operate in?

- What are your business goals?

- What activity do you focus on; performance or brand?

- What is your position within your competitor set?

- What’s your budget?

Learning how to use new tools can take time, but the long-term benefits will be worth the short-term effort required. During this current economic downturn, budgets are being scrutinised, meaning that it is unlikely that you are going to have access to every data source out there. Meaning that when it comes to selecting which tools to use, prioritise them in order to get the best value for your business.

With this in mind, we have created the below to help you prioritise the tools most helpful for you.

Tool prioritisation framework

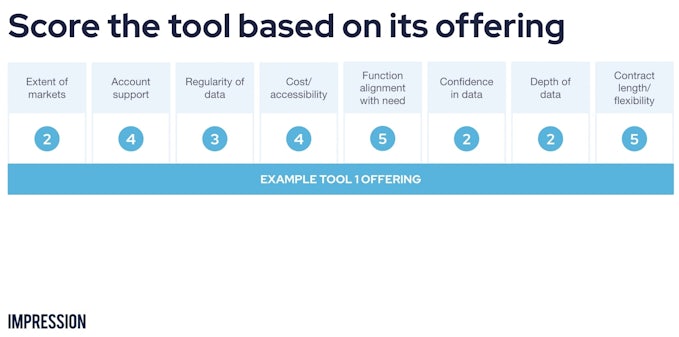

Firstly, we need to identify the criteria. To get a good starting point we’ve listed a few points below that you may want to have in mind.

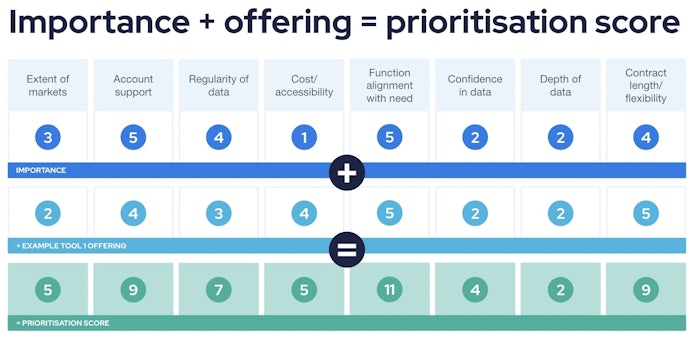

These are only a few examples but provide a good starting point. Out of these criteria, you then need to assign a score based on importance. Think about what factors will matter to you the most. Is it the cost or accessibility? The number of markets, or the amount of support you will get from the account team?

Score the most important as 5 and the least important as 1.

Next, take each tool and score their offering, using 5 if the tool performs well in relation to your business need, or 1 if it performs poorly. It would be ideal if you could find tools that give you a good idea of what it will be like to use before making a purchase, such as live demos, q&a, and even free trials. Once scored, it should look something like this….

After that, combine the ‘business needs’ score with the ‘tool offering’ score. This will give you a good indication of which tools are the strongest contenders for the areas that matter to you.

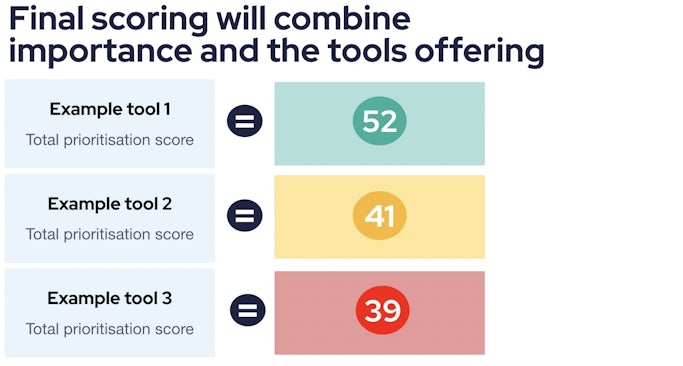

There are a couple of options from here about what to do with the final score. You could take the top 5 criteria that are important to you and add the prioritisation scores together to get a total figure, for example.

What we did, as we felt all criteria should be considered based on our requirements, was add all the prioritisation scores together to get a total prioritisation score.

This activity can then be completed for each of your tools, meaning each tool will have a total prioritisation score. This can then be compared to all the other tools you have completed the process with which will allow you to understand which tools are best suited to your business need. Beyond this, this will also help you make a business case internally for why this tool would be useful and why you have chosen it.

Here are the tools we have looked at, but the list of possible tools out there is endless. If you are starting out trying to find a good range of tools to evaluate, this could be a good starting point.

Key takeaways

Choosing the right tools can have a significant impact on your strategic recommendations. It’s unrealistic to have access to every tool out there given the cost and time it takes to conduct data analysis. Think strategically about which will provide the most meaningful value for your business.

The better equipped you are with the right tool kit, the more confident you can be in your decision-making. The better your decision-making, the more effective your marketing will be.

This blog is adapted from a talk at an online event.

Presentation slides