As marketers, we are all familiar with this scenario: stakeholders who are struggling to hit their performance targets want to pause their Brand spend because it ‘doesn’t contribute to sales’. ‘Brand’ spend is frequently the first thing to be cut when business objectives aren’t being met, when targets are increased, or in response to wider marketplace fluctuations and uncertainty.

This reaction illustrates the misconception around the contribution of ‘Brand’ spend to ‘Performance’ outcomes, positioning Brand campaigns as a ‘nice to have’ rather than a crucial building block for long-term, sustained growth. It’s this silo that’s leading to inconsistent strategy, underinvestment, and deprioritisation of brand-building activities.

However, we know that branding must have an impact on sales performance. Otherwise, why would the world’s biggest brands continually invest in Brand campaigns? Coca Cola could surely save millions in advertising costs every year, yet continue to run primetime TV advertising every Christmas (1993–), and continually roll out innovative branding campaigns including their ‘Share a Coke With…’ named bottles and cans (2011–) and more recent out of home Recycle Me campaign (2024) which used just the logo and the instantly recognisable shade of red. Puma’s ‘Runners High’ (2025), Heinz’s ‘It has to be…’ (2025), and Kellogg’s ‘See you in the Morning’ (2024) are all recent examples of well-known brands executing high-impact and undoubtedly costly Brand campaigns.

Common measurement mistakes limit the perceived contribution of Brand activity

A traditional Brand campaign is designed to drive awareness, recognition and recall through a coordinated deployment of high-impact, brand-led, memorable activations. By contrast, traditional Performance campaigns have the goal of driving direct action, usually sales, and often with strict efficiency targets. Business decision makers reporting on this activity can see the direct impact that Performance campaigns are having on sales, but cannot easily conflate Brand KPIs with bottom line performance. When they do map Performance KPIs directly onto Brand activity, limitations in reporting lead performance to appear inferior.

This is due to digital attribution models used to measure the performance of online advertising frequently defaulting to last-click modelling. This means that the last activation to precede a conversion receives the full credit for driving the action. With Performance campaigns targeting users already showing intent to purchase, they are likely to be deployed toward the end of the conversion journey. By contrast, brand-building frequently targets a new, broad audience at the start of their journey. This leads to an inflated perceived contribution of Performance tactics, and heavily underplays the impact of Brand building.

With this in mind, it’s clear to see how business decision makers – under constant pressure to drive profit – continually fall into the trap of prioritising Performance campaigns which have a clear, direct and short term impact on sales, and neglecting the role of Brand activations, where the KPIs seem disconnected from sales performance – yet the benefit to long term growth is non-negotiable.

Case Study: Navigating reporting limitations to understand the true (and crucial) contribution of Brand Marketing

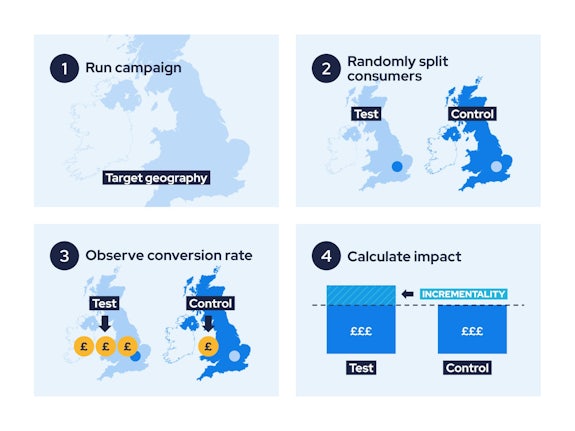

A tried and tested approach to measuring the impact of brand campaigns can be conducted via incrementality testing. This allows marketers to understand the performance of the Brand campaign’s KPIs – awareness, recognition, recall – but also ensure these activations are contributing to business objectives, such as sales.

In this example, our approach began with the implementation of a geo-split test, where at least two regions are identified. All marketing is kept the same except for the test activation, which runs in the ‘test’ region and is absent from the ‘control’ region. Throughout the campaign duration, conversion performance across the two regions is compared, and it is determined whether any incremental sales were recorded, which can be attributed to the brand activation (the only difference between the two regions).

Demonstrating the impact of Brand building on conversion performance was key to justifying long-term Brand campaigning for one of Impression’s biggest clients. An automotive marketplace wanted to run a YouTube campaign focusing on brand awareness, but needed to demonstrate the value of the activation against the business objective – driving leads. The campaign was set up to reach new users who had not previously engaged with the brand, combining both a high reach, broad targeting segment, with a more specific in-market strategy. Campaign success in terms of ‘Brand’ KPIs was measured using in-platform lift studies (Google’s intrinsic Brand and Search Lift Studies), and a regional incrementality test was set up to determine whether the activity contributed to an uplift in leads – its ‘Performance’ impact.

The campaign delivered a 5% uplift in brand awareness, as well as a 179% uplift in searches for the brand across Google and YouTube, demonstrating success against the campaign’s Brand KPIs. The incrementality test showed a 10% increase in leads in the first 3 weeks of the YouTube campaign being live. By contrast, in-platform reporting, limited by last-click reporting, captured only 3% of these leads.

Without the incrementality test results, the impact of the Brand campaign would be limited to its performance against the top-of-funnel metrics only. Despite indicating positive behavioural shifts, these results would not provide the necessary evidence that Brand spending contributes to sales performance -– or more concerningly, in-platform conversion reporting used in lieu of proper incrementality testing would incorrectly underreport on the contribution of Brand, potentially perpetuating the misconception we set out to rebuke: that Brand is a ‘nice to have’ rather than an essential component for growth.

The Importance of Brand and Its Contribution to Performance

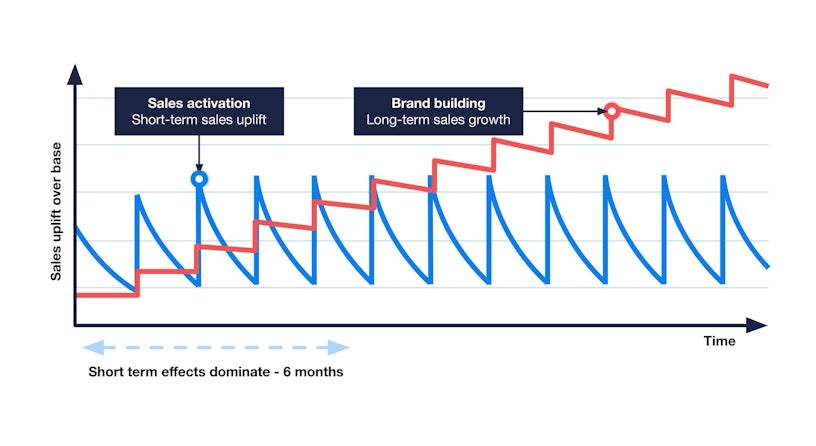

Binet & Field’s infamous ‘The Long and the Short of it’ concluded that brands need both sales activation (short-term, ‘bottom of funnel’) and brand-building (long-term, ‘top of funnel’) activity to drive growth. They posited that while sales activations will harvest existing, short-term demand, it is imperative to seed the ground with new prospects that you will grow, nurture and then harvest when the time is right. These are your long-term brand-fed prospects.

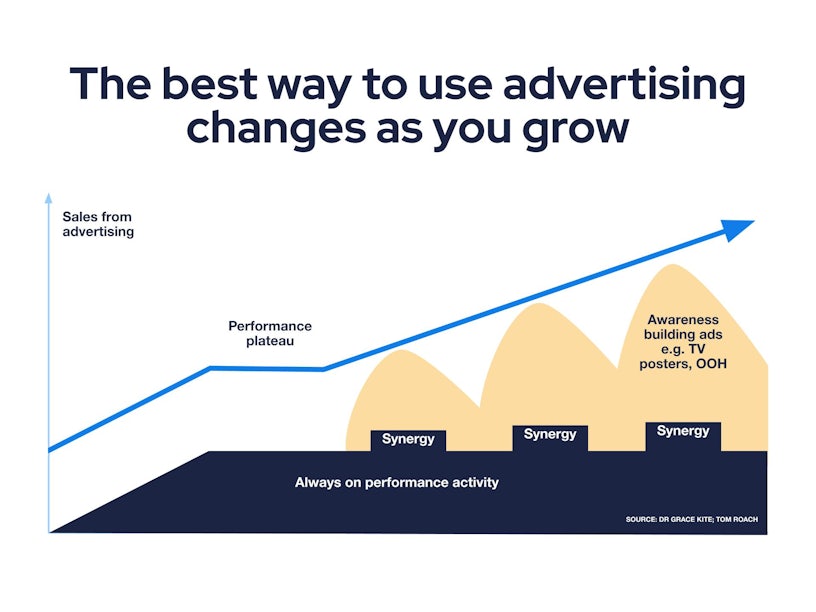

For marketers who neglect to invest in Brand, they can expect to reach their Performance ceiling, characterised by inflated CPAs and declining ROAS, once audience saturation is reached. The audience targeted in these campaigns is finite, and with no plan to replace their converted or non-converting prospects, growth is out of reach.

Dawes quantifies this notion: at any one time, only 5% of your audience are in-market to purchase, the other 95% are not. This means that a Performance-only strategy is reaching just 5% of your potential audience, with the remainder likely untouched without a long-term Brand solution to prime them for future action. To address this imbalance, Binet & Field suggest up to 60% of advertising spend should fund brand-building activities, with the remaining 40% driving short-term sales performance (although there will be a level of nuance to be considered). Airbnb have championed this shift from a Performance-first strategy to a Brand-first one over the past couple of years – and according to their CFO, they’re not looking back.

Has siloing Brand and Performance created a false dichotomy?

Despite acknowledging that both brand building and sales activation are essential for long-term growth. Labelling them as disparate concepts perpetuates the narrative that each is only able to serve the short or long-term purpose it was created for.

Firstly, any marketing activation produces two effects on sales: a larger, immediate sales uplift but with a quicker decay, and a smaller, sustained impact that decays more slowly over time. For example, promoting a time-limited offer will drive a large initial sales spike, with a smaller lasting impact which decays faster, while a brand campaign launch may generate a smaller initial sales impact but with a longer tail that decays more slowly. We saw this evidenced in our own case study above – a positive uplift in incremental sales was observed within the first three weeks of the campaign, as well as uplift across awareness and search behaviours.

Later iterations of Binet & Field’s ‘steps’ model aim to address the symbiosis of Brand and Performance deployed together – the original being limited by its oversight of the – albeit smaller – short-term contribution of brand building, and the possible longer-term contribution of sales activations. The scenario could be as follows: after seeing an initial sales uplift following the launch of a Performance campaign, sales begin to plateau, and efficiency begins to decrease. This is an indication that your Performance ceiling has been hit (you have saturated your audience). The decision is made to deploy brand-building activity. This activity is responsible for a small amount of its own sales in the short term and improves the efficiency and volume of sales achieved by the Performance activity by virtue of raising the Performance ceiling, thus increasing the total volume of sales over time.

Recognising the mutual importance of Brand and Performance is only one challenge

Putting the necessary infrastructure in place to address this within marketing teams is something entirely different. Delivering a holistic strategy addressing both short and long-term growth encounters obstacles when teams are so frequently siloed into disparate business units. Vying targets and budgets only leads to a widening divide between Brand and Performance activities.

To address this, some brands and agencies employ Performance Branding tactics as a way to bridge the divide – a ‘two for the price of one’ approach that combines the principles of both tactics within one message, producing mixed results. Examples suggest that moving away from emotional, authentic storytelling synonymous with Brand to introduce direct response messaging within the same activations falls flat, while others suggest that customer-centricity, holistic KPIs and creative intelligence are the emulsifiers needed to combine the two. Others suggest that the jobs to be done by Branding and Performance are more top-down (Brand) and bottom-up (Performance). That is to say that Brand should be handled at a global level, ensuring holistic, concise and cohesive storytelling, while Performance is regional to incorporate local nuance.

Impression navigate these business siloes by ensuring cohesion and fluidity across the Paid Media team. We avoid making pre-determined assumptions on channel value, and instead gather evidence on the causation of performance through incrementality testing and media-mix modelling. The team is then able to plan media investments based on a longer-term and holistic view of channel contribution, whilst using in-platform data for short-term insight and campaign optimisation.

To get the best out of this way of working, we position our Paid Media offering as a single service, with the agility to move time and budget across the marketing mix, to wherever we’ve determined the most value will be found. Our team are trained to think across the full customer journey, to build a strategy focused on sustainable, long-term growth.

While we can’t expect organisational structures to change overnight, budgets to suddenly be combined and global and local teams to manifest out of nowhere, we can support brands who choose to take the measurement of their Brand activity seriously, helping them to deploy the advanced measurement tactics necessary to connect top-of-funnel KPIs with critical business objectives, and ensure they recognise the power – and necessity – of brand building on their long term growth.