Travel industry trends are being shaped by rapidly evolving consumer expectations, digital innovation, and a growing demand for more meaningful, sustainable trips. From immersive cultural experiences and climate-conscious travel choices to the continued rise of flexible, remote work-enabled itineraries, travellers are no longer settling for one-size-fits-all experiences

We’ve seen how travel brands are shifting their strategies to meet these changing demands; reimagining how they engage audiences at every touchpoint. The future of travel is being defined by personalisation, authenticity, and convenience, all of which are pushing brands to think beyond traditional marketing models. From catering to solo digital nomads or multigenerational families seeking sustainable escapes, we’re here to cover the travel trends shaping the industry this year and beyond.

- What’s the outlook like for the travel industry?

- The value of the industry and looking ahead

- The latest movers and shakers in travel

- Challenges facing travel brands

- The sustainability challenge: High demand, complex implementation

- Economic pressures: Rising costs and its impact on travel

- Top three travel industry trends

- Luxury and Wellness Travel

- Personalised Travel

- AI in Travel Planning

- How is consumer behaviour changing?

- The rise of the solo traveller

- From business to bleisure

- Making the holiday budget go further

- Evolving marketing tactics for travel

- Loyalty marketing: Beyond airmiles

- Travel brands are standing out with DOOH advertising

- P&O Cruises – Immersive 3D DOOH at Waterloo Underground Station

- Isle of Man Tourism – Airport‑specific DOOH Airport Network

- Eurostar – Live‑Reactive DOOH Around Paris 2024 Olympics

- Norse? Atlantic Airways - Weather Triggered DOOH

- TV inspiration

- Jet2 – Viral Jingle from TV Ad

- Tourism Australia – “Come and Say G’Day”

- Grow your travel & tourism brand with Impression

What’s the outlook like for the travel industry?

The value of the industry and looking ahead

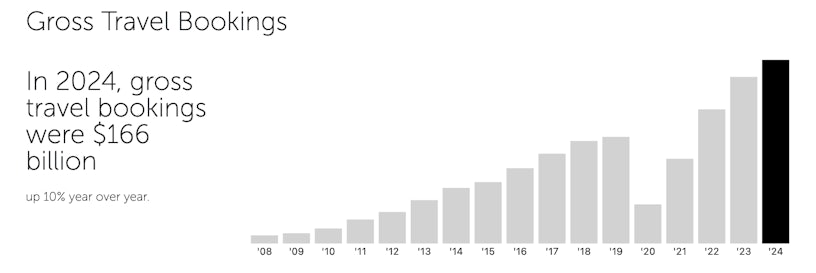

The global travel industry remains a powerhouse, with revenue projected to reach $988.52 billion in 2025.

Breaking down the sector’s success among the top-performing markets, hotels ($455.15 billion) and package holidays ($330.17 billion) generated the most revenue in 2025, highlighting the continued preference for these travel experiences. This presents strong opportunities for businesses looking to expand in these markets.

Looking ahead, the industry is set for steady growth, surpassing pre-pandemic levels. Global travel revenue is expected to rise at an annual rate of 3.99%. This means there could be exciting times ahead for travel brands with the opportunity to seize the rise in demand and turn it into new growth opportunities.

The latest movers and shakers in travel

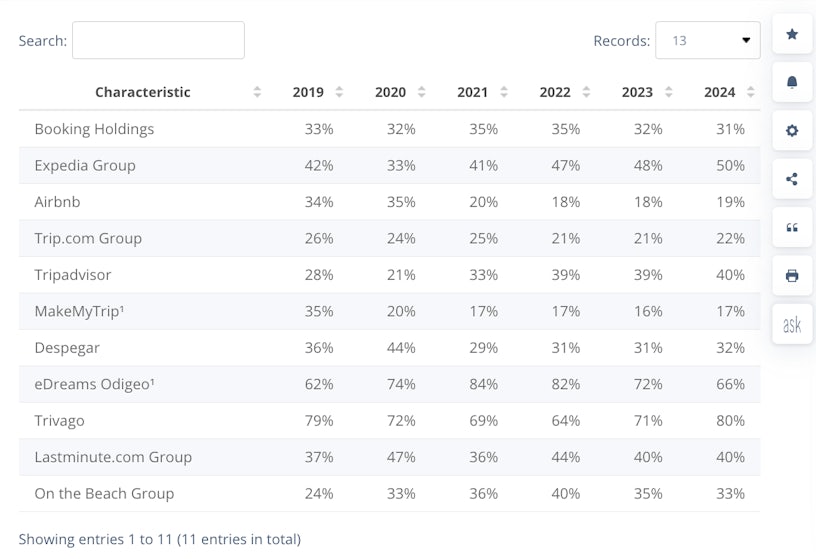

While the travel industry is extremely competitive, there are a number of major players, with Booking Holdings, Expedia Group and Hilton leading the way.

In May 2025, Booking.com, part of Booking Holdings, ranked as the most visited travel website worldwide, attracting approximately 463 million visits. It was followed by TripAdvisor with around 129 million visits and Airbnb with about 92 million. However, with many consumers now opting to book and browse through apps, when looking at app downloads, last year, Airbnb came out on top with 75.84M downloads.

Part of Booking.com’s success is linked to the fact that they secured their spot as one of the most recognised travel portals in both Europe and the US, despite the impressive growth of competitors such as Airbnb and Tripadvisor. By continuing to be one of the most known and loved brands in these markets, last year Booking.com saw its highest ever year for revenue, generating 23.7 billion U.S. dollars.

But how has Booking.com been so successful online? The brand has openly spoken about its move to finding a better balance between brand and performance marketing – their appearance in the 2022 Super Bowl commercial line-up was one of their more notable moments since making this move.

They’ve also been embracing the power that social media holds by focusing on ‘experience-based’ messaging and leveraging content creators to make authentic content to deliver this message. And clearly, it’s working.

While Airbnb might not be the biggest OTA in terms of revenue, it certainly is one of the most talked about. Since entering the market back in 2008, they’ve continued to be big disruptors. Their asset-light model meant they could easily scale globally and offer consumers a totally new way to travel, which has been a key messaging point in their marketing campaigns. But what really sets Airbnb apart is their overall approach to marketing.

In early 2021, they decided to shift their marketing spend to invest in more brand marketing, and in turn, it drove significant results. Besides driving strong revenue growth YoY, their revenue has continued to far outweigh their marketing spend, demonstrating the power of their brand.

Marketing to revenue ratio of leading online travel agencies (OTAs) worldwide from 2019 to 2024

Challenges facing travel brands

The travel industry is navigating a rapidly changing landscape, with several key challenges posing obstacles to growth. From sustainability expectations to economic pressures and disruptions in domestic travel, businesses must adapt to meet evolving consumer needs.

The sustainability challenge: High demand, complex implementation

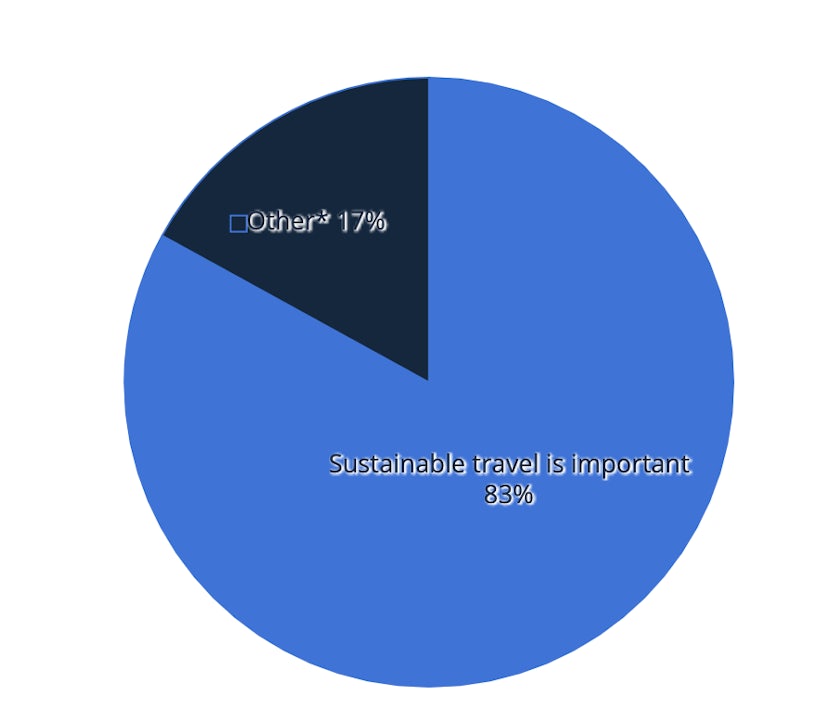

Last year, 84% of global travellers stated that sustainable travel was important to them, and the data shows it’s a growing priority that travel brands need to pay attention to.

While sustainability is a cause close to the heart of many Gen Z’s, millennials and high-income households earning over £80K are most likely to agree that sustainability in travel is important.

These travellers are actively seeking eco-friendly goods and services, putting pressure on hotels and travel businesses to demonstrate their environmental, social, and governance (ESG) commitments. However, the industry faces significant hurdles in implementation. High energy consumption, extensive staffing requirements, and inconsistent reporting standards across jurisdictions make it difficult for brands to showcase their ESG credentials effectively.

Despite these challenges, investing in sustainability initiatives and transparently communicating these efforts can drive long-term success. Travel businesses that prioritise ESG improvements are likely to gain a competitive edge, attracting consumers who align with these values.

Economic pressures: Rising costs and its impact on travel

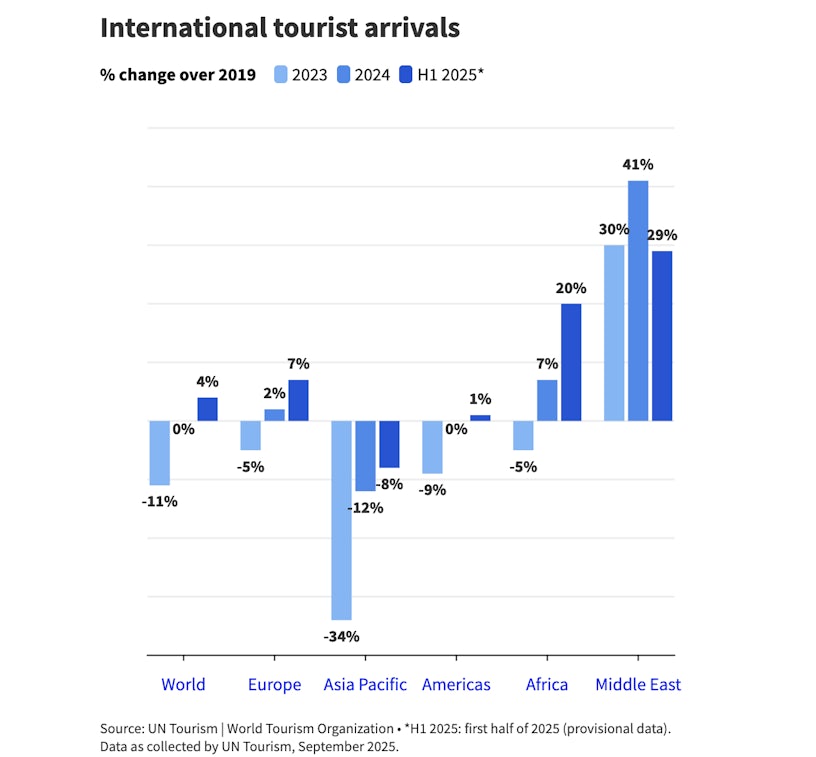

Despite the global challenges that have existed since the start of the year, international tourism was reported to be up 5% in the first half of 2025, showing positive signs for the future of the sector in several different markets.

But while this is a great start to the year, economic and geopolitical factors continue to pose important risks.

According to UN Tourism, the September survey of the Panel of Tourism Experts and the UN Tourism Confidence Index point to high transport and accommodation costs as well as other economic factors as the top two challenges impacting international tourism in 2025.

Tourism inflation is expected to ease from 8.0% in 2024 to 6.8% in 2025 (projections using tourism inflation proxy), but would remain well above the pre-pandemic value of 3.1% and significantly above overall inflation (4.3%). According to the Panel, this rise in expense means tourists will continue to seek value for money, but could also travel closer to home, make shorter trips or spend less, in response to elevated prices.

Looking more broadly, as the world continues to experience feelings of uncertainty from economic and geopolitical tensions, we can expect this to impact travel confidence. Lower consumer confidence was ranked as the third main factor affecting tourism in the September 2025 survey, while geopolitical risks (aside from ongoing conflicts) ranked fourth. The increase in trade tariffs (5th) and Travel requirements (6th) were also major concerns expressed by the Panel of Experts.

Despite global uncertainty, travel demand is expected to remain resilient throughout the remainder of the year. UN Tourism’s January projection of 3% to 5% growth in international arrivals for 2025 remains unchanged and demonstrates that now, more than ever, is a time of opportunities for brands looking to grow in the sector.

Top three travel industry trends

Luxury and Wellness Travel

As travellers become more conscious of their well-being, luxury and wellness travel is well and truly on the rise.

According to Mintel, as consumers worldwide recognise the importance of sleep for their health and wellbeing, the global sleep industry has seen significant growth in recent years. So in some cases, consumers are using their holiday time as the perfect opportunity to catch up on some much-needed sleep.

The demand for sleep-centric accommodations has grown significantly, with 70% of luxury travellers opting for hotels that offer specialised sleep amenities. Quality sleep is now a priority, with 63% of travellers admitting they sleep better alone, and 75% of parents preferring to sleep apart from their children while on vacation to ensure a good night’s sleep. And for those who may be feeling a little tired when planning their trip, over a quarter of travellers plan to book a spa or wellness treatment to improve their sleep during their holiday. This shift highlights the increasing desire for relaxation and rejuvenation, making wellness retreats and sleep-focused accommodations key players in the industry’s evolution.

While luxury travel continues to attract high-end leisure travellers, with most under the age of 60, spending in this segment peaks between 40 and 60, younger travellers are demonstrating a growing willingness to indulge in premium experiences. Many cite disconnecting from digital devices and meeting new people as key motivations for their travels.

Responding to this demand, brands like Waldorf Astoria Hotels & Resorts are expanding into sought-after destinations, while Hilton’s luxury portfolio has now surpassed 500 properties worldwide as of 2024. With an increasing emphasis on relaxation and rejuvenation, wellness retreats and sleep-focused accommodations are becoming integral to the evolution of luxury travel.

Personalised Travel

Unsurprisingly, as travellers seek a more luxurious trip, they are looking to do more than just sightseeing; they crave unique, immersive experiences tailored to their interests and give them that ‘once in a lifetime’ kind of experience. But authenticity is key, with 74% of travellers valuing recommendations from locals to make their trip more unique.

While you may imagine this trend is more prominent against solo or younger travellers, this is true, and solo travel is gaining momentum. 76% of Millennials and Gen Z are planning independent trips in 2024, a trend that is expected to continue into 2025. But, while it is popular, it does not mean it’s exclusive to them only. 73% of parents prioritise cultural experiences when travelling with children, showcasing that everyone is craving a unique experience, and it’s fast becoming a key element to any holiday.

Adventure travel is another major draw, with 1 in 4 travellers planning to seek out unique experiences and 20% aiming for outdoor adventures. As more travellers want to get out and about while on holiday, the number of car rental users is forecasted to continue to rise over the next 5 years, jumping from an estimated 646 million users in 2025 to 815 million in 2029.

Whether it’s a solo city escape or an off-the-beaten-path adventure, travellers are prioritising meaningful, personalised journeys. So, as a travel brand, it’s essential that you are not only offering the ability for your customers to live out these experiences, but also are bringing it to life through your messaging and creative. You want to show them that adventures are to be had across the world and in all shapes and sizes, as while there are some hot spot destinations for these holiday types, at the end of the day, we all have different aspirations and find joy in different activities, so showcasing the ‘perfect’ holiday is key.

AI in Travel Planning

The travel industry is one that continues to be impacted by the influence of AI. The launch of LLM platforms such as ChatGPT has dramatically changed the way in which consumers research and plan their dream holiday.

But with AI continuing to shape and change our world as we know it, it is no longer just being used for research. Younger generations, particularly Millennials and Gen Z, are leading the adoption of AI-powered tools, with 83% finding them useful for booking trips. Apps like Hopper use AI to track and predict the best deals on flights and hotels, simplifying the booking process.

Familiar tools such as Google Search, Maps, and Lens are also integrating AI capabilities, enhancing trip planning and offering real-time, location-based recommendations to offer a better experience for travellers.

As technology advances, there is no doubt that AI-driven travel solutions will become even more indispensable to travel brands of all kinds.

How is consumer behaviour changing?

Consumer behaviour in the travel industry is shifting rapidly, shaped by technology, values-driven decision-making, and a post-pandemic emphasis on flexibility and control. Here are some of the most notable changes travel brands need to know:

The rise of the solo traveller

A few years ago, if you said solo travelling, you would perhaps picture that one friend or family member who was brave enough to jump on a plane with a one-way ticket to go explore a destination far away. But today, solo travelling is more than a niche; it’s a cornerstone of consumer behaviour globally. For travel brands, this signals a strategic pivot: tailor operations, marketing, and offerings to empower and engage the independent, experience-focused solo traveller.

According to Hilton’s 2025 Travel Trends UK report, 34 % of Brits want to take a “Me-Moon” before the end of 2025. Of these, 21 % aim to make new friends while travelling solo, and 12 % are open to romance. A similar trend is happening over in the US, where 57 % of Americans prefer short solo weekend getaways, and roughly one-third are planning solo trips to new cities. This is a huge change from recent years – globally, 58 % planned solo travel in 2024

But what’s driving the surge in popularity?

A desire for mental wellness, self-discovery and the flexibility of remote/workcation travel are the key drivers behind this growing trend. Women are also the dominant audience group, with 84% of global solo travellers being women. In fact, in 2024, 55% of all Google searches for ‘solo travel’ are now being females and mostly made up of millennials.

With the key drivers likely to stay a key part of our new everyday life and culture, there is no doubt that solo travelling is here to stay, and there’s huge potential for travel brands to tap into. Tailoring your offering to something that has the solo traveller in mind should be a key part of your strategy for 2025 – consider safety, social and solo-friendly accommodation as essentials and then ensure your messaging and targeting are aimed at this growing audience.

From business to bleisure

Blending business and leisure continues to gain momentum in 2025 as consumers increase their focus on their work-life balance and take advantage of more flexible work policies to bring the two worlds together.

A recent survey by American Express states that a significant 87% of Millennials and Gen Z treat business travel as an opportunity to explore new places, with 80% carving out leisure time during work trips. In some cases, the younger generation would go as far as inviting a guest on a work trip, reflecting the desire to blend business and leisure.

The mindset shift from “office-first” to “results-first” means workers are more likely to add personal time before or after work trips, especially when travelling to attractive destinations. Beyond this, with economic pressures and high travel costs, consumers are combining work and personal travel to get more value from one trip.

This is a trend that Airbnb have certainly cottoned onto and benefited from, but they are not alone. Hotels, airlines, and destinations are now designing experiences around bleisure travellers: longer-stay offers, coworking spaces, wellness facilities and extended checkout times. Corporate travel programs are also beginning to support bleisure more formally.

In short, bleisure is being accelerated by work flexibility, generational expectations, wellness priorities, cost efficiency, supportive corporate policies, and improved travel tech. Together, these trends are reshaping how travel brands design products, experiences, and policies to attract and support the modern business‑leisure traveller.

Making the holiday budget go further

While consumers want to enjoy the holiday of their dreams and holiday spending continues to be prioritised over other non-essential spending, economic pressures are still heavily influencing consumer behaviour within the sector.

One of the most obvious ways in which consumers are making holidays more affordable is taking advantage of any bundle or subscription offers, so buying now and paying later to spread the costs into more manageable instalments.

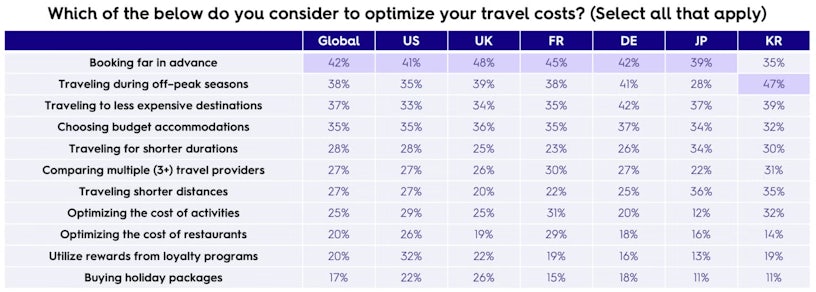

But for the most savvy travellers, there are a few other budget strategies that they are leveraging.

Globally, 42% of travellers are opting to either book early, with the UK and France being the most likely to do so. Other popular methods for saving money included travelling in off-peak seasons and choosing less expensive destinations – perhaps leading more consumers to look for more of those ‘undiscovered gems’.

But this doesn’t mean they are booking on a whim; if anything, due to their desire to be cost-efficient, the booking journey is longer than ever. According to Criteo, ‘travellers consider 4 air travel options and 21 hotel listings before booking’. That’s significantly more hotel options than flight,s and leaves the hotel booking path to be crowded and competitive.

Another cost-saving technique is looking for dupe destinations. As many as 63% of U.S. travellers are increasingly choosing to pick alternative ‘dupe’ locations to those that are more expensive. This is something that has been reflected across the social media world, where you see content creators sharing their dupe, or hidden gem locations, which are positioned as alternatives to popular destinations.

But, for those who simply want to spend less but still escape their everyday life, there has been a rise in scaling back by either reducing the length of time or location. In the US, this year, it is expected that families will spend around 25% less on their holiday due to reasons such as wanting to save or not having the money. They plan to spend less by swapping expensive flights and hotels for drive-to destinations, day passes, and local deals.

Evolving marketing tactics for travel

Travel brands are increasingly adopting innovative marketing tactics to capture attention and drive bookings. While loyalty programs like Emirates Skywards and Marriott Bonvoy continue to reward repeat customers and build long-term relationships, the way in which brands use more digital out-of-home (DOOH) advertising and TV campaigns is emerging as a powerful tool to engage audiences in real time.

DOOH enables location-aware, immersive, and reactive messaging, while TV combines storytelling, humour, and celebrity to create memorable campaigns that resonate across multiple platforms. Together, these strategies show that travel marketing is evolving beyond points and perks—delivering experiences that are both personalised and highly visible.

Loyalty marketing: Beyond airmiles

In a world where consumers seek a more personalised and ‘rewarding’ experience when interacting with brands, and where brands are looking to nurture and retain their customers, loyalty marketing has a big role to play in the future of travel marketing.

Travel brands worldwide are increasingly turning to loyalty marketing to deepen customer relationships and drive repeat bookings in a highly competitive market. Airlines like Emirates with its Skywards program and hotel groups such as Marriott with Bonvoy are using points, tiered rewards, and personalised offers to encourage travellers to stay within their ecosystems rather than shopping around.

Skywards membership has shown a steady upward trajectory, from 20 million in 2018 to over 30 million by 2023, reflecting robust growth. Similarly, the Marriott’s programme has been well received by consumers across the world and as a result scaled massively; significantly outpacing many competitors with membership nearing the 280 million mark as of late 2024. This makes it the largest programme in its sector.

Consumers love it because it goes beyond the classic airmiles incentive and rewards travellers with Skywards Miles and Tier Miles, which unlock different types of benefits. Having a tiered benefits system means users have excess to different benefits, which is a great way to make it accessible to a wider audience, while also making customers in the top tiers feel more valued.

The lower tier unlocks benefits such as air miles and partner discounts, while the highest tier offers bonus airmiles, a free gold card for a partner or spouse, first-class check-in and lounge, guaranteed economy seat (even on fully booked flights) and priority on a waiting list for upgrades. All in all, they offer exclusive benefits that improve the experience of flying.

Far from declining, loyalty marketing in travel is a growing trend, fueled by digital platforms that allow brands to deliver tailored perks and seamless redemption options. Consumers are generally receptive, with many valuing not just discounts but also exclusive experiences, convenience, and recognition, making loyalty programs an important differentiator in how they choose where to fly or stay.

Travel brands are standing out with DOOH advertising

In 2024 and early 2025, several travel brands in the UK have raised the bar in digital out‑of‑home advertising, using real‑time data feeds, immersive creative formats, and location‑aware messaging to captivate audiences and drive measurable impact.

P&O Cruises – Immersive 3D DOOH at Waterloo Underground Station

P&O Cruises launched its first-ever immersive, programmatic 3D DOOH campaign at London Waterloo, where commuters descending the escalators were immersed in an undersea world with fish seemingly swimming out of screens. The campaign ran from December 2024 to early March 2025 and was created by Wavemaker UK, GroupM and DOOH.com, using geo‑location targeting and live API feeds that displayed real‑time ship positions and destination weather updates. Viewers were later retargeted via immersive 3D audio and display ads. The campaign earned the IAB UK Joy of Digital Award in February 2025 for its innovation and experiential impact.

Isle of Man Tourism – Airport‑specific DOOH Airport Network

Running across JCDecaux DOOH screens in key UK airports, including London, Edinburgh, Manchester and Bristol, the Isle of Man Tourism campaign featured highly personalised creative messaging directed at travellers. Each creative was tailored to travellers based on their departure city, highlighting the exact distance to the Isle of Man. According to StackAdapt, these DOOH ads delivered a 263 % increase in click volume on searches for “Isle of Man,” underlining the campaign’s significant uplift in engagement and awareness.

Eurostar – Live‑Reactive DOOH Around Paris 2024 Olympics

During the Paris 2024 Olympics, Eurostar ran a live-reactive DOOH campaign across London and other UK cities via Ocean Outdoor and JCDecaux. Creatives automatically updated whenever Team GB won medals, aligning the brand with national excitement in real time and leveraging emotional connection via dynamic placements.

Norse Atlantic Airways – Weather Triggered DOOH

Established in 2022, Norse Atlantic Airways is a challenger airline, operating low-cost transatlantic flights from Europe to North America. It’s seen impressive growth over the last few years, capturing market share on competitive routes traditionally dominated by long-standing airlines.

At the start of 2024, Norse launched flights to winter sun routes: Jamaica, Barbados and LA. With these routes already having substantial competition and a high seasonality trend, Norse

challenged Impression to drive awareness of its new routes to a highly relevant audience.

Research showed that Norse’s target audience is inspired by idyllic social media depictions, others take recommendations from friends and family, and some are looking to escape bad weather. Knowing that bad weather is a key driver of holiday bookings, we determined that Digital Out Of Home (DOOH) activity would allow us to reach our audience at the most poignant moment – when they are outside experiencing it

Our programmatic experts launched a weather-reactive strategy using the two most common weather conditions for January and February in the vicinity of Norse’s home airport – rain and cloud. The messaging would acknowledge the current weather conditions and encourage our audience to ‘ditch their wellies’ in favour of the warm weather in the new travel destinations.

The results clearly show that DOOH brand activity has a halo effect on online media, driving engagement amongst primed audiences.

TV inspiration

Jet2 – Viral Jingle from TV Ad

What started as a TV advert has turned into a viral phenomenon for Jet2. Back in 2022, they launched their summer campaign, which featured the catchy jingle that was reused in-flight and quickly became a staple in their brand suite. However, three years later, the ad’s catchy jingle was lifted from Jet2’s TV spot and began being reused by TikTok creators.

The initial wave of memes paired the upbeat audio that claims ‘Nothing beats a Jet2 Holidays’ with contrasting, often disastrous scenarios such as airport chaos, sunburn, or everyday mishaps, which in turn created humour content for social. From TikTok, the trend quickly spread to Instagram Reels and X (Twitter), where it reached a wider audience and became one of the summer’s most viral soundtracks. It has now been featured in more than 1.3million videos.

This rapid evolution of a meme reminds brands that sometimes a little humour can go a long way, and can play very much into the hands of online creators who have huge influence. It also shows how impactful something so simple and traditional, such as a jingle, can be, and while it wasn’t planned by the brand, the fact that they have embraced this growing trend has only helped to boost their presence online.

Tourism Australia – “Come and Say G’Day”

Australia’s tourism board is continuing its global “Come and Say G’Day” campaign, refreshing the series with localised celebrity ambassadors for different markets: Robert Irwin in the U.S., Nigella Lawson for the U.K., plus regional figures in India, China, and Japan.

The humorous and heartwarming spots feature iconic Aussie tropes like Irwin rescuing a tourist stranded in the outback and Nigella enjoying a BBQ banquet, which are all humorous and tailored for each audience. The advert blends several smart marketing principles, and as a result, it has been highly effective.

As a result, the original campaign goal was more than doubled, securing 1.06 billion earned media impressions through 516 placements, largely driven by national US TV placements and online syndication of content in US media. Based on the ad equivalency of $6.67 million from earned media generated, Tourism Australia recorded an ROI of 10:1.

What’s more, since its launch in October 2022, the ‘Come and Say G’day’ campaign has increased holiday consideration for Australia by 10% in the US, UK and China.

For travel brands considering using TV in their marketing mix in the future, they can certainly learn that combining humour, celebrity, a focus on experience and the need to make content that can be distributed across multiple video platforms is definitely a guaranteed path to success.

Grow your travel & tourism brand with Impression

We’ve helped to grow a range of global travel brands through our digital marketing service offering, spanning everything from overarching digital strategies to SEO, paid media, and digital experience.

Ready to learn more about what we can do for your business? Get in touch today.