This month we bring you some exciting developments and updates from the world of search.

After a turbulent period for search rankings, Google wrapped up its third core update of the year in early December. As with previous updates, this is designed to improve the relevance and usefulness of search results, ensuring a better experience for users.

Additionally, Google has provided clearer guidance on “site reputation abuse,” addressing a topic that gained attention after several prominent websites faced manual actions. These clarifications come as commentators speculate on the increasing impact of reputation abuse on search visibility.

Finally, Google has introduced new tools in both Google Analytics and Google Search Console. These updates are geared toward helping users quickly uncover potential issues and opportunities.

We’ll explore these updates and more in detail in the article below.

Allow our traffic light system to guide you to the articles that need your attention, so watch out for Red light updates as they’re major changes that will need you to take action, whereas amber updates may make you think and are definitely worth knowing but aren’t urgent. And finally, green light updates which are great for your SEO and site knowledge but are less significant than others

Keen to know more about any of these changes and what they mean for your SEO? Get in touch or visit our SEO agency page to find out how we can help.

In this post, we’ll explore:

- November Core Update

- Google has updated its Site Reputation Abuse policy

- Recommendations now live in Google Analytics and Google Search Console

- Merchant Center Recommendations

- How to access the new recommendations in GA4

- Google Search Console Recommendations

- How to access the new recommendations in Google Search Console

- Google CTR Stats – Changes Report for Q3 2024

- CTR by Sector

- CTR by Search Intent

- Impact of keyword length

- Search demand by industry

- Google's update on their compliance with the DMA

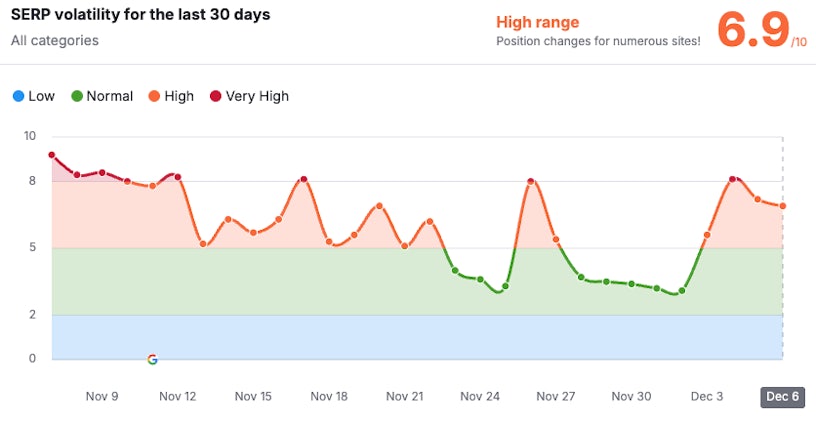

The November Core Update began on the 11th of November and concluded on the 5th of December, spanning approximately 24 days despite it being estimated to take 2 weeks. Like previous core updates, its primary goal was to enhance the relevance and usefulness of search results for users.

This update prioritised rewarding websites that adopted a user-first approach and demonstrated strong E-E-A-T signals—Expertise, Experience, Authority, and Trust. Sites that excelled in these areas either maintained or improved their rankings.

Since the last core update in August, SERP volatility has been notable. Before the November update, volatility levels were relatively low and stable, despite a brief spike earlier in the month.

During the update rollout, fluctuations increased slightly but remained moderate coinciding with the Black Friday shopping event at the latter end of November. Towards the end of the update, especially around 25th November and 4th December, volatility spiked significantly, indicating substantial ranking shifts as the update likely reached its critical phase.

SERP volatility in the US and UK mirrored similar trends, however, volatility was much more pronounced in the US, reaching very high levels throughout the rollout:

Google previously stated that websites that were negatively impacted by the September 2023 helpful content update should not expect to see recoveries as a result of this latest core update.

Explore our comprehensive guide to read more about all the Google algorithm updates to date.

Earlier this year, Google introduced a spam policy aimed at tackling site reputation abuse. In mid-November, the company clarified the policy, defining site reputation abuse as:

“The practice of publishing third-party pages on a site in an attempt to abuse search rankings by taking advantage of the host site’s ranking signals.”

It is important to note that not all third-party content breaches this policy. Typically, violations occur when the third-party content is unrelated to the overarching theme of the website. For example, if a recruitment firm hosts content about high street discount codes, this would likely be flagged as a policy violation.

When a site breaches this policy, it is flagged under Manual Actions in Google Search Console.

The enforcement of this policy has impacted major organisations, including Forbes Advisor, which was entirely removed from Google’s index. Previously, the publisher hosted a wide variety of content, with Sistrix reporting articles ranging from “best CBD gummies” to “best pet insurance.” This diversity in content was deemed inconsistent with the site’s core theme, resulting in a breach of policy.

However, some websites have benefited from the changes. Aleyda Solis reports that specialised review sites, brand-focused websites, and user-generated content platforms have experienced increases in organic search traffic and visibility. This suggests that sites focusing on a specific niche or with a strong brand presence are thriving under the updated rules.

Currently, enforcement relies on manual actions, but Google has indicated plans to introduce algorithmic updates to automatically detect and penalise site reputation abuse in the future.

Google has recently launched recommendations for both Google Search Console and Merchant Center in Google Analytics. These features aim to provide you with easy-to-access recommendations to identify and fix problems but also to spot opportunities for improvement.

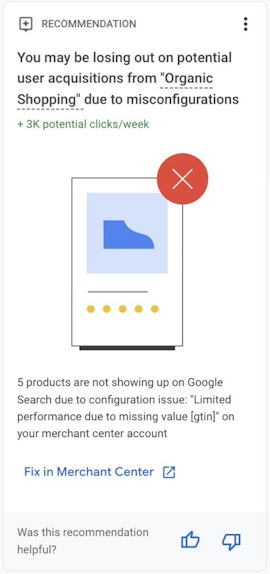

Merchant Center Recommendations

Google Analytics has integrated Merchant Center recommendations directly into its Recommendations section. According to Google, these insights will “alert you to issues preventing your products from being approved in Google Merchant Center.”

The feature helps users identify and resolve product disapprovals, ensuring their items are eligible to appear in Google Shopping results and Shopping ads. By highlighting these errors, this new feature streamlines troubleshooting, making it easier to implement fixes to ensure visibility is maximised for online sales. Google has stated:

“By addressing these disapprovals, you can increase organic traffic from Google Shopping and enhance the performance of your Shopping ads, maximising your online sales potential.”

As disapproved products cannot appear in Google Shopping or Shopping ads, resolving product disapprovals in your linked Merchant Center account is essential for the visibility of your products. Fixing these issues not only improves organic shopping traffic but also optimises the performance of your ads.

How to access the new recommendations in GA4

The new recommendations are accessible in Google Analytics on the Home page, Insights Hub, Reports Snapshot, and the Acquisition Overview Report. They include direct links to the specific products flagged in your Google Merchant Center account.

You can read more about the new Merchant Center recommendations in their official documentation.

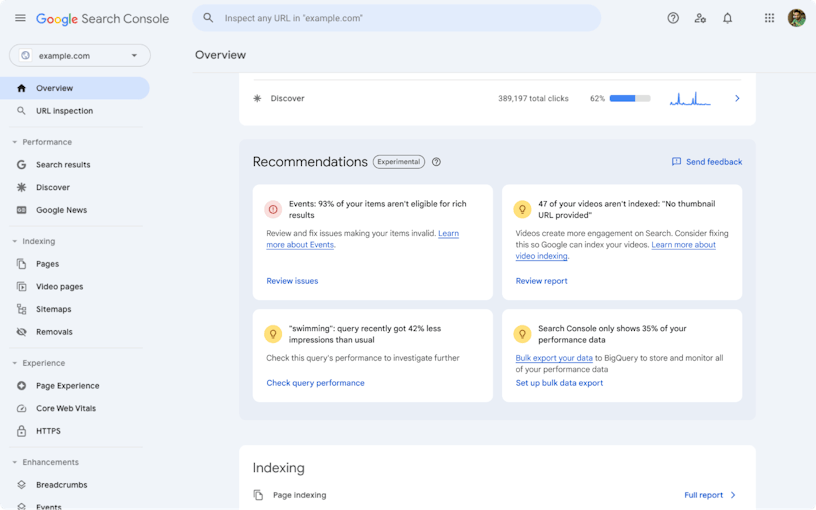

Google Search Console Recommendations

After launching as an experimental feature back in August, Google has now rolled out the new recommendations feature in Google Search Console for all users. Google has stated that the feature helps users identify and resolve product disapprovals, ensuring their items are eligible to appear in Google Shopping results and Shopping ads.

There are three types of recommendations that you may see:

- Issues (something that could be fixed)

- Opportunities (something that could improve your traffic)

- Configuration (something that could make your work easier)

These recommendations offer insights on how to enhance a website’s indexing, crawling, and serving in Google. They highlight opportunities such as implementing structured data and adding sitemaps, as well as suggesting products to showcase on the shopping tab. The recommendations also identify pages that have received fewer clicks than usual, alongside those that are performing well.

How to access the new recommendations in Google Search Console

If opportunities have been identified on your website, they will be available in the Overview section of the Search Console dashboard. However, Google will only provide recommendations when there is an actionable opportunity.

You can read more about the new Google Search Console recommendations in their official documentation.

A report by Advanced Web Ranking assessed the average click-through rates (CTR) of websites across various sectors and search intents in Q3. Here are the key findings:

CTR by Sector

Websites that ranked first in the Personal Finance sector had the highest average mobile CTR at 34.05%. This surpassed the Arts & Entertainment sector, which dropped to 26.95%. This marks a reversal from Q2, when Arts & Entertainment websites had a higher CTR.

CTR by Search Intent

Search intent significantly influenced CTR changes:

- Informational Queries (e.g., “what”, “how”): Mobile CTR increased by 1.63 percentage points (pp), while desktop CTR for second-position rankings dropped by 1.10 pp.

- Commercial Queries (e.g., “buy”, “price”): CTR for first-position rankings decreased on both desktop (-2.55 pp) and mobile (-3.51 pp).

Impact of keyword length

Keyword length positively affected mobile CTR:

- 1-word searches: +1.17 pp

- 2-word searches: +1.14 pp

- 3-word searches: +1.26 pp

Search demand by industry

Several industries showed notable CTR changes:

- Science: Desktop CTR increased by +2.48 pp, mobile CTR by +4.16 pp, and impressions surged by 33.78%.

- Automotive: Desktop CTR grew by +2.95 pp, mobile CTR by +1.40 pp, with an 11.24% increase in impressions.

- Law, Government and Politics: Experienced the steepest decline, with desktop CTR for second-position rankings dropping by -9.74 pp.

However, some industries experienced mixed results:

- Education: Desktop CTR dropped by -6.26 pp, but mobile CTR grew by +2.53 pp.

- Business: Desktop CTR fell by -3.72 pp, while mobile CTR increased by +1.52 pp.

- Personal Finance: Achieved the largest growth in mobile CTR for first-position rankings (+5.47 pp), despite a -9.92% decline in impressions.

The Digital Markets Act (DMA) has required Google to significantly change its services in Europe. In response, Google has implemented over 20 adjustments to ensure compliance, including redesigning or removing features in services like Google Search.

Key changes include:

- Enhanced visibility for comparison sites: Google introduced dedicated units and formats to boost the prominence of comparison sites, free of charge, in categories such as flights, hotels, and shopping.

- Feature reductions: Some features, like detailed flight information, were removed, while others, like clickable maps, now have reduced functionality.

Google claims that these changes have negatively affected the experience of European users while benefiting comparison sites and travel aggregators at the company’s expense. The adjustments have led to reduced direct traffic for airlines, hotels, and small retailers, with free direct booking clicks declining by 30%.

Despite these efforts, Google claims that comparison sites are demanding even more changes. In response, the company has proposed the following updates:

- Expanded choice formats: Users will have clearer options to navigate between comparison sites and direct supplier websites.

- Enhanced displays: Updated formats will include prices, images, and details for both comparison sites and suppliers.

- New ad units: Dedicated advertising formats for comparison sites will be introduced.

To evaluate the impact of these proposals on user experience and website traffic, Google will conduct a small test in Germany, Belgium, and Estonia. During the test, certain hotel features, such as maps and extended hotel results, will be removed from Google Search and will be replaced by a list of individual links to external websites without additional features.

While expressing reluctance to implement these changes, Google emphasises that they do not align with the interests of consumers or businesses. However, the company believes its latest proposal strikes a balance between meeting DMA requirements and preserving user benefits.